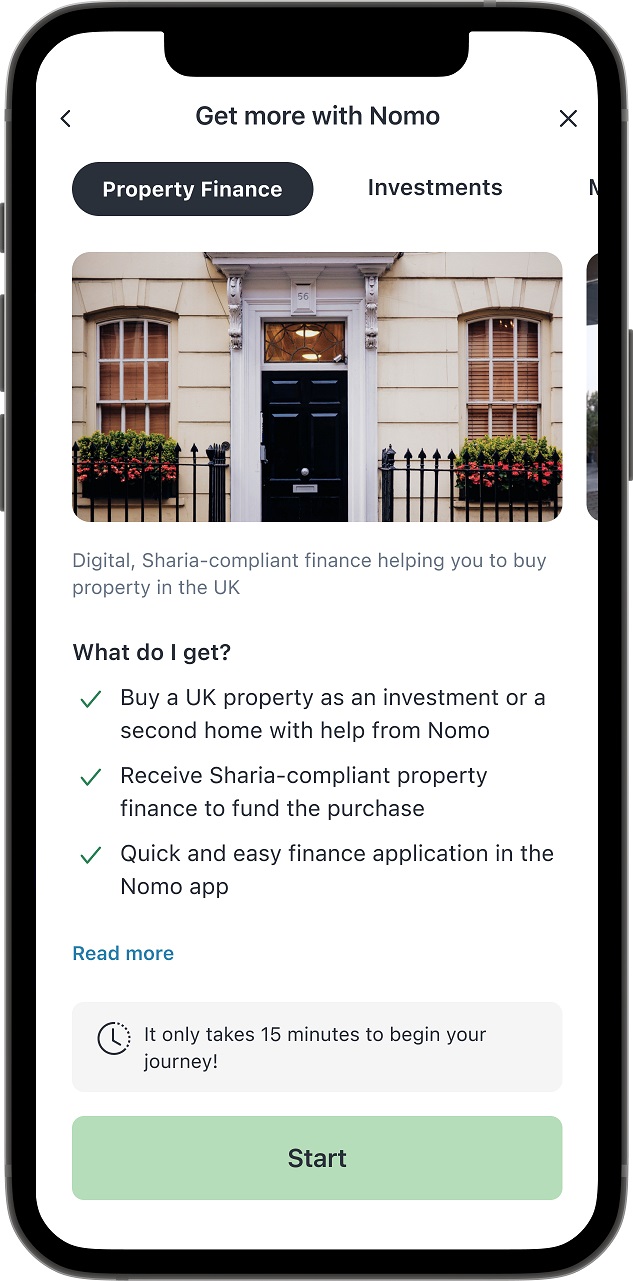

Nomo, the world’s first fully-digital Sharia-compliant cross-border bank, has announced the launch of Nomo Property Finance, its mortgage alternative for clients in the Middle East wishing to buy property in the UK. Operating under a Murabaha structure and in line with Islamic banking principles, Nomo Property Finance will initially be available for customers in Kuwait and the UAE, followed by a roll-out to other GCC countries in the near future.

The United Kingdom remains a preferred destination for Middle Eastern investors looking to own an international property. With UK property prices continuing to become more affordable, Nomo customers can now explore investment opportunities in one of the world’s most attractive property markets. By combining Sharia compliance with innovative technology, Nomo will continue to disrupt the $1.7 trillion global Islamic banking sector.

“At Bank of London and The Middle East, we are committed to delivering financial solutions aligned with Sharia principles, while embedding industry-leading innovation across our services. As Nomo Bank, a BLME subsidiary, launches its property finance solutions, we are excited to give Islamic Banking customers access to one of the most exciting global property markets in the world,” said Andrew Ball, CEO, Bank of London and The Middle East.

“As Middle East customers look to own a property in the UK, Nomo Bank is streamlining the house-buying process with fast, digital-focused applications and a quick decision process,” Sean Gilchrist, CEO, Nomo Bank, said. “As a Sharia-compliant bank, we understand the needs of every one of our customers, which has allowed us to innovate and build products like Nomo Property Finance, and help them achieve their ambition of owning a property in the UK.”

Property finance customers will first need to open a UK bank account with Nomo before applying for property finance and ultimately purchasing their desired property. With rental and residential finance solutions, Nomo’s finance products are suitable for those looking for a second property in the UK as well as clients whose goal is to build a UK property portfolio to rent out to tenants as an investment. Nomo offers finance for properties above 350K GBP, including new builds, in England and Wales.

Eligible property buyers can apply for a UK bank account, from the Middle East in minutes via the Nomo app. Customers aren’t required to be present in the UK or have an existing credit score there to apply for property finance.

“Middle East property buyers without a UK bank account have historically found it much more difficult to complete the property buying process due to several factors such as credit history. We aim to provide a straightforward pathway for our clients to get the finance they need, thereby making property ownership accessible to our customers around the Middle East,” Mr Gilchrist added.

The provision of a UK-based current account also allows buyers and landlords to pay their cross-border deposit in the local currency, and benefit from fee-free transfers when paying property maintenance fees and receiving rental income.

Nomo’s mission is to make international banking, investments, and property finance accessible to customers who seek global market access and a world-class financial services experience. By reimagining international banking for customers from the Middle East, we are creating opportunities for affluent customers who seek a global financial solution underpinned by easy-to-use technology.

Nomo is part of Bank of London and The Middle East plc (BLME), a subsidiary of Boubyan Bank, one of the leading financial institutions in the Middle East.