A virtual space race to the ‘metaverse’ has begun. What does this immersive online future hold, why is it important, and where do we find value? As investor interest surges, we weigh up the short-term hype and long-term opportunities.

When Facebook changed its name to Meta Platforms in October, the word ‘metaverse’ moved from the domain of tech geeks to the mainstream. Surging interest reflects the intrinsic draw of thematic investments, especially within the technology sector. Despite the long-term attractiveness of the metaverse concept, we believe we are currently in ‘over-hyped’ territory: a common phenomenon that we also saw with the advent of 3D printing, various stages of 3G/4G/5G wireless technology and the ‘Internet of Things’. Yet while investors tend to overestimate the short-term impact of new technologies, they also tend to underestimate the long-lasting influence on the competitive landscape of such a tectonic shift. We examine the possibilities and likely impact overleaf.

- What is the metaverse?

There is no single definition of the metaverse, which is a portmanteau word combining ‘meta’ meaning ‘beyond/after’ in Greek, and ‘universe’. It is a hypothesised iteration of the internet. The most common description of the metaverse is a virtual-reality space, or an alternative economy or world in which users can interact with other users within a persistent computer-generated environment. Users are most often represented by avatars: a digital icon or figure representing a particular person. The metaverse can be accessed using a collection of technologies, for example computers or smartphones, but more typically – and immersively – via augmented or virtual reality glasses. For investors keen to have a preliminary glimpse into what a metaverse might look like, we suggest watching Steven Spielberg’s movie Ready Player One.

One of the most advanced companies on this front is Meta Platforms (formerly Facebook). Its Virtual Labs division offers virtual reality headsets (Oculus Quest), which from 2022 will also include early-stage mixed reality with face & eye tracking technology. The firm also offers development tools (SparkAR) that enable creators to build new virtual experiences. An interesting use-case is represented by the SuperNatural app, part of its Virual Labs division, which is an immersive, virtual reality fitness service for the Oculus Quest. The app offers new workouts daily that transport the user to the most stunning destinations in the world, while working out with real fitness coaches.

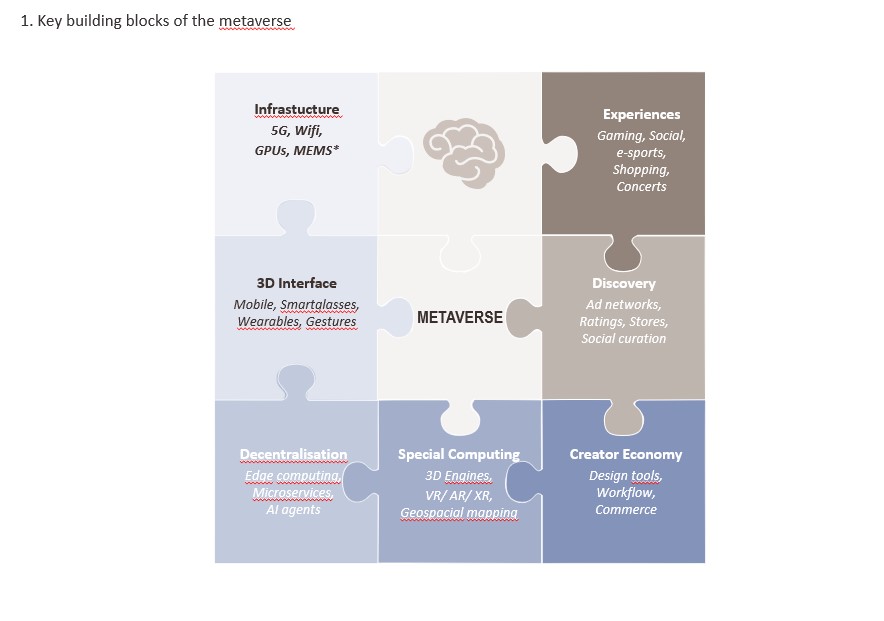

What are the key building blocks of the metaverse?

On the opposite page, we illustrate the seven layers needed to build the Metaverse ecosystem. These include the backbone infrastructure and tools required, spanning connectivity, computing, and the user interface and virtual environment. The 3D environment and geospatial mapping form the Extended Reality fabric, representing the combination of mixed, augmented, and virtual reality. Most of the required technologies to create this ecosystem already exist, while others are still work-in-progress. On top of these, many services will evolve to build out the content (the creator economy), market it (commerce) and make it discoverable (search). The final expression of the metaverse will be through experiences, encompassing games, social interactions, shopping, education, and live events like sports and concerts.

At this point in time, we only have very limited examples of “tentative” metaverses. The best example would be the video games universe, epitomised by the free-to-play game Fortnite or the user-generated platform Roblox. Both of these demonstrate some of the aforementioned characteristics: they go beyond just playing games, by incorporating aspects such as virtual concerts or shopping for digital assets. In these cashless virtual environments, blockchain technology and cryptocurrency could play a key role. The blockchain technology supporting non-fungible tokens (NFTs or digital tokens that represent ownership of assets) could also create an interesting ecosystem for digital content creation and monetisation. For example, these could confer the right to use artworks or own creatures created in the metaverse, opening the door to a new virtual economy. In this realm, human creativity has virtually no limits.

- Why might the metaverse become important?

The goal with the metaverse is to build an immersive experience that becomes the successor of the mobile internet. Whether it is to meet, work, play, learn, or shop, metaverses will be about consuming content in real time through virtual experiences; they represent the shift from a place to share experiences, to a place of shared experiences.

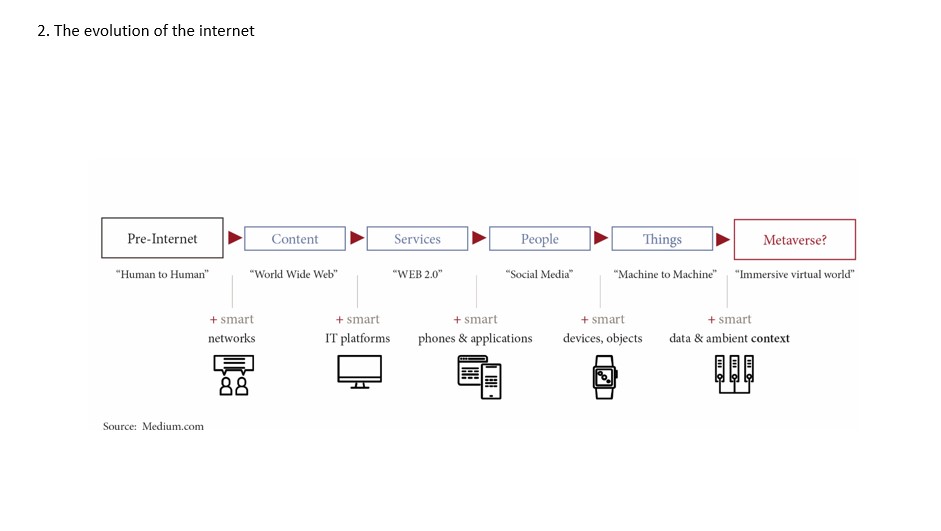

As illustrated in the flow-chart below, digital history has evolved from what our children would refer to as the Digital Stone Age (pre-internet) to the World Wide Web (access to content Whatever Whenever Wherever), followed by the internet of services, as improving IT platforms unleashed e-commerce and interactivity as well as productivity to drive innovation. The next step stemmed from the rapid proliferation of smartphones, which gave birth to the hyper-connected society and the virus-like spread of social media. Nowadays, the technology is not just in our pockets, but all around us, thanks to the plethora of connected devices powered with sensors and connectivity (the Internet of Things). The internet has moved from humans talking to humans, to humans talking (or at least trying) to talk to machines and thus to machines talking to machines. This evolution is radically changing human relationships. Sometimes, the technology does not just augment our skills, but substitutes us, when algorithms can perform specific tasks with unrelenting precision. With the advent of the metaverse, we are about to enter another phase, where virtual interactions will once again take centre stage.

What are the main challenges?

As the technological foundations are still evolving, no agreed standards for inter-operability across the multiple metaverses have been set. This is in our view a critical point, as consumers expect to seamlessly move and share virtual assets and experiences across various platforms, and developers expect to freely choose the relevant cross-platform tools. Looking ahead, we anticipate that many large-scale platforms will need to adjust their business models in order to operate within an inter-operable metaverse. Privacy and data security will also be crucial, given the large quantity of potentially sensitive personal information involved. Other concerns revolve around mental health, if virtual worlds lead users to shy away from real-world responsibilities and interactions.

- How can we gain exposure to this theme?

In the short-term, we note that investors have a tendency to overrate the impact of new technologies, pushing up valuations as money flows to a select number of “thematic pure play names”. Usually, tangible results lag expectations, as deployment and implementation tends to be more complicated and time consuming than anticipated. The metaverse is indeed an interesting technology opportunity, but with still distant tangible economic benefits.

Creator tools and workflow advancements are critical to metaverse content creation. We can envisage a world where it is as easy to build content in the metaverse as it is to set up an e-commerce site today. The debate around closed versus open platforms is often mentioned as the key blocking obstacle here, creating a tug-of-a-war situation. Walled gardens (i.e. closed platforms) typically solve some of these content creation issues because they are willing to offer everything to their users. By contrast, assembling all the necessary tools in an entirely open ecosystem is difficult, at least in the early stages of development. We note that today’s legacy players could have a head start in building the necessary tools and equipment.

We believe the main investable areas will ultimately be across the companies supplying the key building blocks and tools to support the metaverse infrastructure. These building blocks and tools are currently leveraged for other purposes, including digitalisation, cloud computing, artificial intelligence (AI), and video games graphics, which somewhat dilutes the thematic exposure purity. The initial basic experiences will gradually get more sophisticated, but in the meantime this phase will be characterised by heavy investments and little profits, as the lack of interoperability and standards will hamper wider adoption among potential users. We believe the metaverse vision and its economic benefits will not be realised as fast as many hope, creating the risk of disillusion with subsequent risks of drawdowns. For now, we advise investors to be prudent in allocating money to this theme as the returns will be spread over multiple (5-10) years and the technology roadmap is still at a very early stage, leaving plenty of questions unanswered.

However, there is also a tendency for investors to under-estimate the influence on the competitive landscape that such seismic shifts in technology can have. These are not always perceptible, but are still material. In the medium-term (2025 onwards) the key metaverse building blocks should be mature enough to start creating more specific/dedicated investable business opportunities, especially in the experiences segment. Considering the still uncertain timing and following a standard S-curve adoption, we could see incremental opportunities materialise at this later stage. For now we would caution would-be metaverse investors to keep their feet firmly planted on the earth.

Key takeaways

- The metaverse represents the next iteration of the mobile internet: immersive, virtual and interactive

- While nascent versions exist, the technology is some way off maturity, with a lack of system interoperability a key obstacle. Many companies will have to adapt their business models to work within an inter-operable metaverse

- Investors tend to overestimate the short-term impact of such technologies, driving up valuations, but underestimate the long-term influence on the competitive landscape

- From 2025 onwards, more specific investable opportunities should arise, especially in the experiences segment