Wio Bank has launched Wio Family, the UAE’s first fully shared banking experience – and a movement that rethinks how families save, spend, and plan together. Wio Family offers shared banking, built in response to a growing need among households for a more collaborative, transparent, and intuitive way to manage money.

As the UAE prepares to enter the ‘Year of Family’, highlighting the importance of strong family relations and unity, Wio Family reflects the simple truth that money is rarely an individual matter – it is shared, fluid and deeply social, shaped by the people we live with.

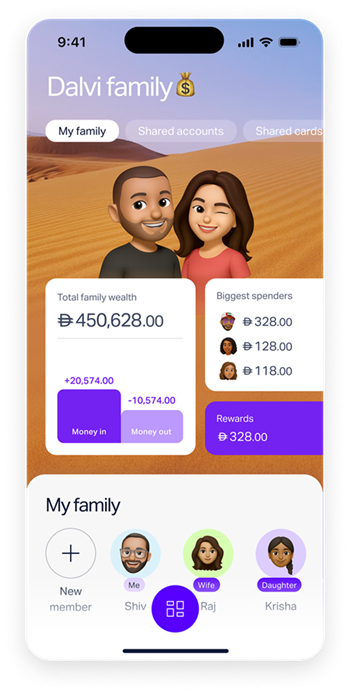

Co-created with real families across the nation, the new experience brings every household member into one connected financial space – through a shared bank account – helping them make better decisions, reach shared goals, and build healthier financial habits. Two ‘Family Leads’, the account owners with equal control, can instantly open the account and invite children, teens, helpers, or relatives to join, making it easier to manage money together.

Wio Family is designed to fit every type of household, reflecting the diversity and evolving nature of modern family life. Whether managing finances with a partner, parent, sibling, or any trusted individual, account ownership is flexible to suit each family’s unique needs. This approach supports couples starting out, multi-generational families, and all those who share responsibility for their household budget.

For children and teenagers aged 8–17, Family Leads can also create Pockets – safe learning spaces designed to teach young members how to spend wisely, save consistently, and understand the value of money from an early age. With their own virtual card and spending limits, children can start building real-life financial confidence in a guided, age-appropriate way.

Jayesh Patel, CEO of Wio Bank, said: “Wio Family was built to address the real needs of families across the UAE, giving them clarity, flexibility, and control over their finances. It reflects a movement towards treating money as something shared – something social – not just an individual responsibility. Our aim is to build with families, for families, and deliver banking experiences that truly reflect modern life. With this launch, we’re rethinking how families manage money, helping them grow together and achieve more of their goals.”

Amina Taher, CMO of Wio Bank, said “We have put real families at the heart of Wio Family and its launch, showing a banking experience that truly reflects their needs and aspirations. Most people are saving for collective dreams, a new home, children’s education, or a wedding, so we want to help them achieve these goals in a new experience that brings everyone who will benefit together.”Wio Family also makes it easier for households to reach goals and achieve dreams faster. Family Fixed Saving Spaces offer up to 6% interest per annum (with salary transfer), the highest across Wio. Families can also enjoy all Family and Personal benefits for free with a total balance of AED 35,000 or more (AED 49/month otherwise).

A suite of smart shared tools allows families to stay in control of everyday spending. Shared virtual cards and smart controls allow Family Leads to set limits, track every dirham, and tailor permissions for each member from one intuitive dashboard. With boosted cashback rewards up to AED 7,500 per month collectively, including 1% on Family debit spends and up to 2% on individual spends, families benefit more from the spending they already do.

This launch marks just the beginning of the Wio Family movement. Wio Bank will continue to roll out more family-first features, insights, and connected tools to make shared money management even smarter, more transparent, and more collaborative.

Wio Family is now available through Wio Personal, with more features set to be introduced in the coming months.