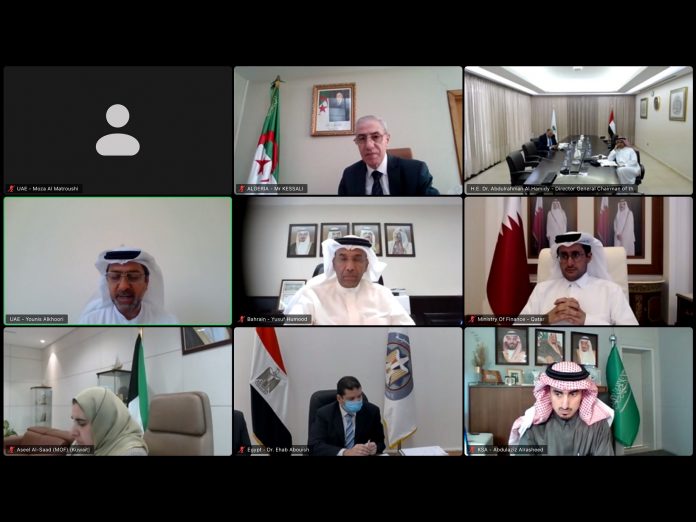

The UAE hosted the sixth Arab Finance Deputies Meeting, which took place virtually on January 20 and 21, 2021. The Arab Monetary Fund (AMF) organized the meeting in cooperation with the UAE Ministry of Finance (MoF). H.E. Younis Haji Al Khoori, Undersecretary of MoF, headed the UAE delegation – which included Abdullah Ahmed Al Obaidly, Director of Relations and International Financial organisations, as well as specialists from MoF.

H.E. Dr. Abdulrahman Bin Abdullah Al Hamidy, Director General and Chairman of the Board of Executive Directors of the Arab Monetary Fund (AMF); as well as Arab Finance Deputies participated in the meeting. Representatives and experts from the International Monetary Fund (IMF), World Bank Group, Organisation for Economic Cooperation and Development (OECD), along with Arab economic experts also attended the meeting.

The first day deliberated two working papers by the AMF titled ‘Tax Treatment of Digital Services in Arab Countries’ and ‘Tax Policy Options to Support SMEs,’ and a working paper by the IMF titled ‘Economic Governance Reforms to Support Inclusive Growth in Arab Countries’. Furthermore, the World Bank Group presented a working paper on the ‘Requirements for the Transition to Digital Economy to Enhance Efficiency and Governance in Countries’.

H.E. Younis Haji Al Khoori thanked the AMF for presenting a working paper on tax treatment for digital services in an objective and transparent manner. H.E. emphasised the importance of the recommendations and future reforms included in the working paper, as the need to impose taxes on the digital economy has currently become a necessity for Arab countries. H.E. noted that if taxes are not imposed – whether direct or indirect – Arab countries may lose outstanding tax revenues that could contribute to strengthening public finances.

H.E. highlighted that entrepreneurship and SMEs sector was a top priority on the agenda of the UAE Government and various Emirati local governments during 2020. All local government entities launched several initiatives and stimulus packages to mitigate the economic repercussions of the COVID-19 pandemic, and upgraded the economy’s legislative and organisational system. That, in addition to devising practical solutions to economic challenges; and creating a stimulating environment for economic development.

H.E. Al Khoori said: “SMEs are a fundamental pillar and a major contributor to the national economy, and they are key to transformation towards a competitive, productive, innovation-and-knowledge-based economy. SMEs contribute to more than 53% of the UAE’s non-oil GDP, and this percentage is expected to rise to 60% by the end of 2021, and to higher levels in the coming years. Also, appointing a Minister of State for Entrepreneurship and SMEs reaffirms the UAE Government’s support to this vital sector, and showcases the government’s keenness to elevate the entrepreneurship sector while providing all means of support to enhance SMEs’ growth. It also reiterates the government’s keenness to increase SMEs’ commercial success opportunities; and boost their products and services’ competitiveness in the local and foreign markets.”

H.E. noted that there was a recent remarkable focus on public finance reforms, due to the ability of large fiscal policy tools to support economic growth. Hence, Arab countries have adopted several public financial management reform strategies that aim to achieve financial sustainability, strengthen fiscal policy’s role in achieving sustainable growth, and ensure budget processes’ efficiency and transparency.

H.E. noted that digital transformation is a key pillar of the UAE’s future vision and the UAE truly was forward-looking by entering the digital world and establishing an advanced digital infrastructure. H.E. said: “Each Arab country is facing several challenges of their own in accelerating digital transformation, foremost of which is the provision of rapid telecommunications infrastructure, and the lack of necessary legislation to deal with this new type of economy. That, in addition to the lack of digital culture among citizens, and the lack of expertise with smart software that deal with the digital economy.”

The second day deliberated ‘Governance of Investments and Public Projects’ and ‘Reforming the Wage and Pension System’ in Arab countries, through presentations by various Arab Finance Deputies. Also discussed was the OECD’s presentation on ‘Trends of International Tax Systems’, in addition to an open discussion between Arab Finance Deputies on ‘The Repercussions of the COVID-19 Pandemic on Fiscal Policy and the Post-pandemic Options Available in Arab countries’.

During his interventions on the second day, H.E. Al Khoori stated that the UAE has adopted a highly transparent governance system along with accurate frameworks to face risks, in order to ensure performance quality and excellence. The governance framework includes a board of directors; subsidiary committees; and assigns roles and responsibilities to the council. It ensures that investments adhere to risk management policies and audits, and also deals with various risks such as systemic and operational risks with high impact. It also approves the business continuity plan and the annual review plan.

H.E. Al Khoori said: “Backed by the national strategy to prepare the country for the coming 50 years, the UAE is proceeding with a forward-looking vision and a consolidated culture of excellence, to elevate its position on global competitiveness indices. For more than ten years, the country has devised a roadmap with clear objectives, to be among the best 10 competitive economies in the world by 2021. Since then, the UAE has attained outstanding achievements, despite the challenges witnessed by the world as a result of the COVID-19 crisis.”

On reforming the wage and pension system, H.E. Al Khoori said: “As part of the UAE government’s endeavor to provide high-quality and distinguished services to mark the UAE as one of the best countries in the world, government human resources management became a major drive for building technical and administrative talent in accordance with the best international standards. This is within advanced legislation, systems and programmes, and in line with the best international practices in the human resources field. This is part of the government’s keenness to provide all means of support to ministries and federal entities to help them invest and elevate their human resources – in order to achieve their goals and the UAE government’s strategy.”

As for the repercussions of the COVID-19 pandemic on fiscal policy, H.E. noted that the UAE Ministry of Finance is coordinating with the competent authorities to analyse proposals to issue new legislation, or amend some provisions of applicable laws’ articles. This is done in a way that serves the current and future phases and promotes comprehensive development in various sectors. The UAE Insolvency Law is one of the most important laws issued in light of the current crisis, as it regulates individual insolvency cases – thus supporting comprehensive development efforts as well as the UAE’s public finances’ sustainability. The Federal National Council has also approved the draft law on Movable Property.

“More than ever, we need to devise a plan to support global recovery. This plan should contribute to and credibly support economies, especially the emerging ones, and help them return to a better position than before the crisis – through readiness, early preparation and devising post-crisis strategies.”, H.E. said.

At the end of the meeting, preparations for the 12th Council of Arab Ministers of Finance meeting – scheduled in April 2021 – were discussed. The final statement of the meeting was deliberated and adopted.