Standard Chartered Wealth Management Chief Investment Office (CIO) released its Outlook 2023 report, outlining its investment strategy and key themes for a continued challenging economic growth backdrop in the year ahead. While slower global growth due to a US economic recession should significantly help to cool inflation, it is likely to remain above levels that central banks are comfortable with. However, it expects growth in China to rebound due to the gradual removal of mobility restrictions and an increased policy focus on growth stabilisation.

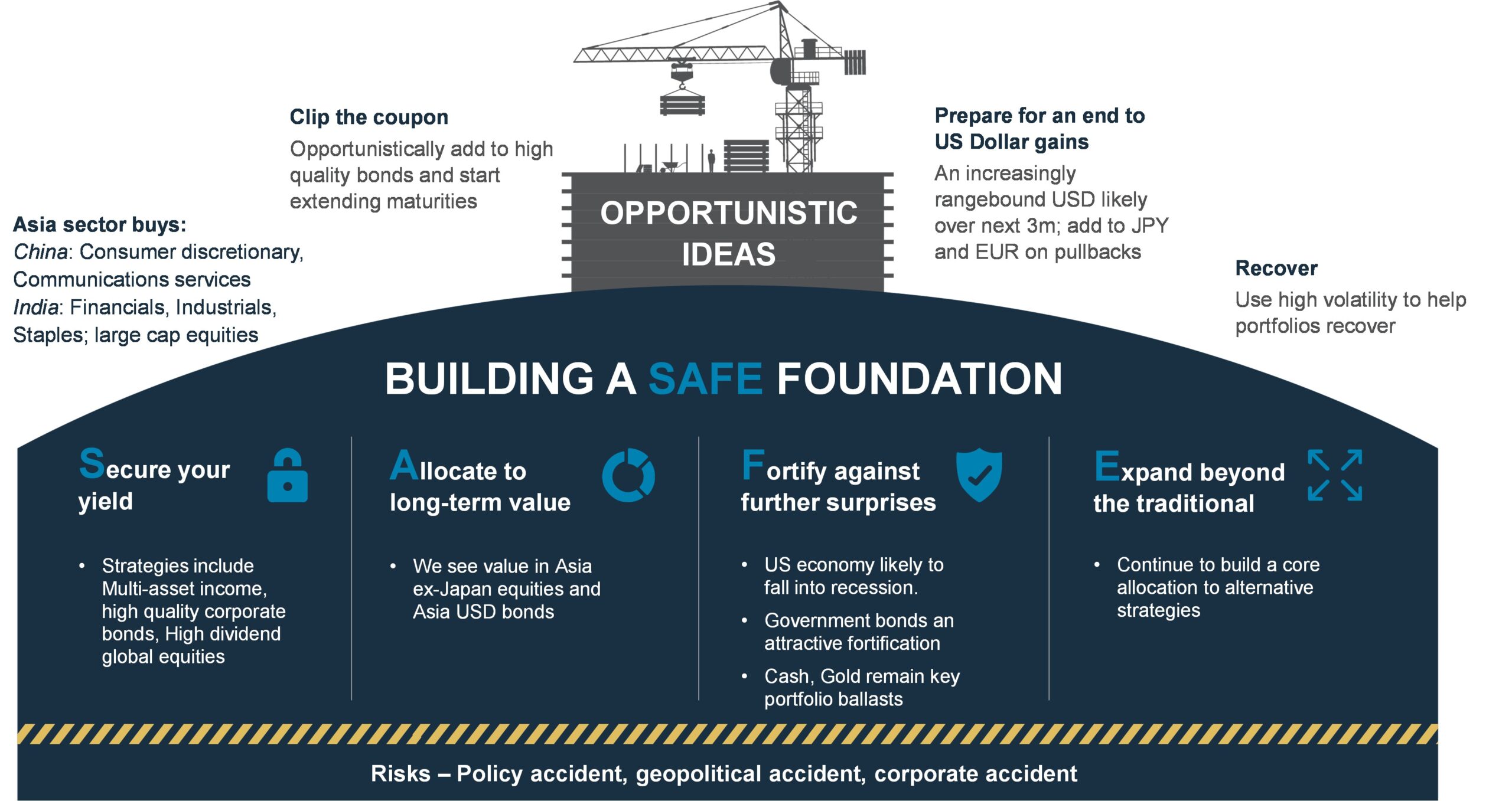

Against this backdrop, the CIO team highlighted its recommendation for investors to build a SAFE foundation:

- Secure your yield: With today’s yield levels being one of the big opportunities in 2023, the team is overweight bonds – including government and high-quality corporate bonds – relative to equities and cash.

- Allocate to long-term value: The more immediate opportunity in yield levels should be balanced by exposure to longer-term value, which it primarily sees in Asia ex-Japan equity and bond markets. Within Asia ex-Japan, the team is overweight Chinese equities given their inexpensive valuations and positive catalysts. Another attractive asset class is Asia USD bonds.

- Fortify against further surprises: A US recession outlook means investors need to be prepared for downside surprises, and high-quality government bonds can be one such mitigant. Cash and gold are also key portfolio ballasts.

- Expand beyond the traditional: With the belief that the unusual rise in stock-bond correlations this year is unlikely to last into the next, demand for relatively uncorrelated assets is likely to sustain. Alternative strategies, such as liquid alternative strategies and private asset classes, can help.

The CIO Office team expects currency markets to be another source of opportunities, with the US Dollar likely to turn lower over the next 6-12 months as the Fed offers a catalyst in the form of a pause in the rate hiking cycle. The team is bullish on the EUR and JPY, expecting them to be strong performers on a full year basis, and would use any Q1 weakness to add exposure.

Sector picks are another source of opportunistic returns – these are more pro-cyclical given the CIO team’s overweight view on Asia ex-Japan. In China, the communication services and consumer discretionary sectors are expected to benefit from increasingly supportive policies and reduced mobility restrictions, while in India, the financial, industrial and consumer staples sectors should benefit from domestic demand. Sector preferences in the US are more defensive – the healthcare, staples, and energy sectors – while in Europe, the financials and energy sector are preferred.

Steve Brice, Group Chief Investment Officer, said: “2022 was a year of great drawdowns, which scarred many investors and left them with unusually few places to seek refuge in the financial markets. The risk of falling prey to recency bias and extrapolating recent trends into the future is very real – but past experiences will tell us this is not usually the case. A fresh perspective based on current market conditions is still likely to best serve investors, and we hope that our latest outlook report, backed by our bespoke investment philosophy, will enable them to better make objective investment decisions that meet their wealth goals.”