Network International Holdings plc provides an update on trading performance in the first half of the financial year and outlook for the remainder of the year.

- H1 total revenue expected to be cUSD133-134m, representing broadly flat y/y performance in Q1 and c(23)% in Q2. Merchant Solutions showing gradual recovery through June and Issuer Solutions performance remained relatively more resilient

- Updated financial guidance for FY20: we expect total revenue decline (17)-(20)% y/y. In the Middle East, we anticipate a gradual recovery of domestic spending through the second half but little return of international spending. In Africa, whilst the business is more focused towards Issuer Solutions, the WHO has indicated Covid-19 has yet to peak and we therefore expect to see further pressure on card issuance and transaction volumes

- Balance sheet and liquidity remains strong, and we expect to remain comfortably within our financial covenants. Intention to move forward with expansion in Saudi Arabia, and on-soil data centre deployment, as soon as practical to do so

- Ongoing delivery of strategic and business initiatives: notable new merchant wins and a partnership with online payments services provider, HyperPay. Growing demand for N-Genius online gateway; e-commerce volumes (excl. Government and airlines) up 45% y/y in Q2. Africa business wins have naturally slowed in the current environment, but we are confident this is temporary with no underlying change in the appetite for banks to outsource payments processing

- The transition from cash to digital payments remains in high growth across our markets, where recent indicators point to an acceleration in this trend. As the regional payments champion, Network International is strongly positioned to capitalise on growth opportunities

Simon Haslam, Chief Executive Officer, commented:

“We have continued to focus on supporting our customers and colleagues through this period. We have enabled online payments for a large number of merchants through our proprietary N-Genius gateway, and have a strong pipeline of demand. Whilst Covid-19 is causing some short term disruption, we are fortunate to be operating in high growth and fragmented digital payments markets, where we are seeing signs of an acceleration in underlying trends and the long term opportunity remains significant. As the only independent payments processor of scale across our regions, we are best positioned to capitalise on these opportunities, which means we continue to pursue new customers, continue discussions with banks in regard to outsourcing, and scan the market for selective acquisition opportunities. There is much to be excited about and we remain confident in the industry fundamentals and our strategic approach, which remains unchanged.”

Trading update

Business operations and market dynamics: Our payments and processing activities continue to be unaffected by the pandemic and supporting customers through this period remains a business priority.

Whilst the majority of our colleagues continue to work from home, we are implementing a phased return to our offices as lockdown measures begin to ease across a number of our regions.

The transition from cash to digital payments continues at pace across our markets and we have recently seen a number of indicators that point to an acceleration in this trend. The contactless spending limit has increased across the majority of Middle East countries, and Governments in the UAE and Jordan are proactively asking consumers to avoid the use of cash. A recent UAE consumer survey from Global Data notes the proportion of people who prefer to pay with cards, rather than cash, increased from 48% to 56% from March through to May. Across Africa, Covid-19 has also become a trigger for e-commerce, mobile money and digital banking. For example, in Egypt, the Central Bank has launched an incentive programme to deliver 100,000 new card acceptance points.

Strategic and business initiatives: In the Middle East, we have delivered on a number of initiatives through the first half. This includes new direct acquiring merchant customers, including: Alexander McQueen, Bvlgari, Adidas and the e-commerce business for major supermarket Spinneys; building on our previously announced Q1 merchant wins with Luxury Fashion Gulf and Western Union. We have also signed a partnership agreement with online payments services provider, HyperPay, which provides access to Shopify merchants. Additionally, we have worked alongside merchants to improve the speed and ease of digital onboarding through this period and deployed teams on the ground to assist merchants as they re-open their businesses. In Issuer Solutions, we have assisted a number of banks and their cardholders, by enabling payment holidays, or extending expiry periods on cards where suppliers could not guarantee a replacement in time. In addition, we have won new business to support the issuance of the first Islamic credit card for a bank in Jordan, alongside the competitive tender we won in Q1 to provide exclusive Issuer Solutions across five countries for CareemPAY. Despite the challenges of merchant closures through the period, the rollout of POS devices on our proprietary N-GeniusTM platform has continued at pace with c4,500 devices distributed during the first half period. A major bank customer, Commercial Bank of Dubai, is also enrolling its merchants onto our N-GeniusTM POS devices. Our proprietary N-GeniusTM online payment acceptance gateway has seen increased demand and we have delivered this capability to nearly 700 customers during the first half, taking the total number of merchants using our gateway to c1000.

In Africa, we have expanded our card processing activities with Fidelity Bank Ghana, and will add a further two million accounts hosted on our platform, for RCS Bank in South Africa. This is supported by the signing of new Issuer Solutions customers, including Globus Bank in Nigeria, and Republic Bank in Ghana, which were secured during Q1. The rollout of our N-GeniusTM POS devices continues with Standard Bank and Orabank across eight countries, and with Arab African International Bank in Egypt. We are also working towards N-GeniusTM gateway implementation with customers after certification in three countries.

Our strategic partnership with Mastercard is focused on developing a digital payments platform that will have the capability to link multiple stakeholders; including banks, mobile network operators, payment service providers, merchants and consumers. The strategic purpose of the platform is to overcome the typical interoperability challenges faced by participants in the payments ecosystem, and improve digital and mobile payments capabilities across our regions. We remain on track to launch two specific payments solutions, developed with support from Mastercard, during the second half of the year: a corporate card solution for bank customers; and a smartphone App with QR code payment acceptance for merchants.

H1 trading: Having recently closed the first half period, we expect to report total revenues of cUSD133-134m for the period; where we saw Q1 revenues broadly flat when compared to the prior year (as previously announced), and a reduction in Q2 revenues of c(23)%.

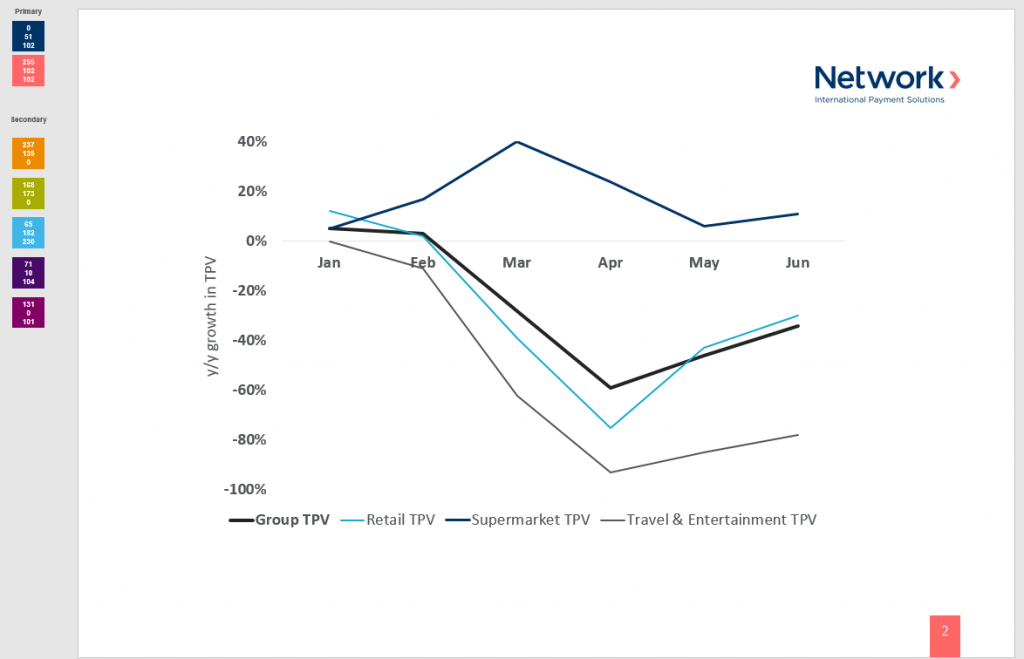

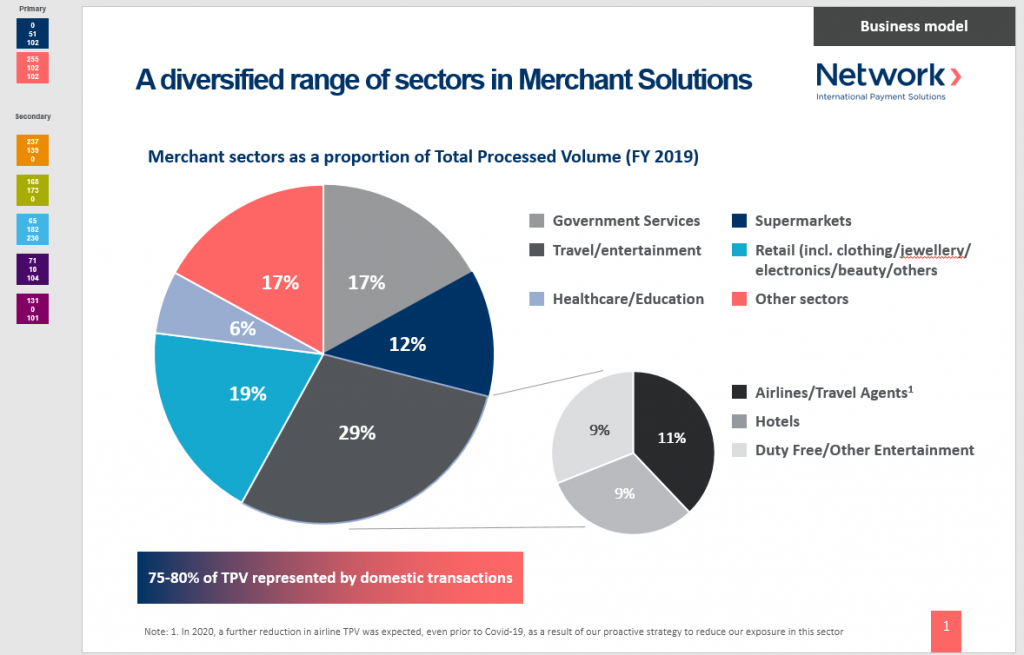

In Merchant Solutions; we saw fairly normalised performance into February, following which there was a slowing of tourism related spend. This culminated in the closure of Dubai airport and stringent lockdown measures across the UAE and Jordan from the end of March and throughout most of May. Lockdown measures started to ease in June and, as a result, we are seeing the start of recovery in consumer spending. Merchants in sectors such as Travel and Entertainment, and Retail, have naturally been most impacted. This has been offset to some degree by Supermarkets, and significant growth in TPV of 45% from e-commerce merchants in Q2 (excluding Government and airline online TPV). Refunds and chargebacks remain within expected levels, with no significant increases. This is representative of our diverse merchant sector base and the ongoing steps we have taken to manage our risks, including holding cash reserves where appropriate.

H1 trends in directly acquired Total Processed Volume (TPV)

Merchant sectors as a proportion of directly acquired TPV (FY 2019)

Issuer Solutions continued to show a more resilient performance through the first half, with fairly normalised trading through January and February. Following the implementation of stringent lockdown measures towards the end of March, and through to the end of June, we saw a reduction of c10-15% year-on-year in Issuer Solutions revenue. Restrictions related to Covid-19 mean that new card issuance is significantly limited by the closure of bank branches, and we are also seeing a greater number of banks reviewing and cancelling inactive cards than would otherwise occur in a normal year.

Regulation: In Jordan, the Central Bank has announced a proposal to reduce the fees incurred by merchants when consumers use debit or credit cards. These proposals are now subject to industry consultation concerning structure and implementation, and are yet to be finalised. The date of implementation is also yet to be confirmed, but could be later this year.

In the UAE, there has been no formal update on the prior announcement from the Central Bank. As we have stated previously, we expect interchange fees to be regulated, which represents the largest cost for the merchant. This would have very little impact on our business, as it is typically a pass through cost.

Guidance and outlook

With improving visibility around business outturn and customer plans, we are providing updated guidance for FY20. We are assuming a gradual recovery of essential domestic consumer spend in our major direct acquiring markets of the UAE and Jordan, reaching closer to prior year levels by the end of 2020. We do not expect international/tourism spend to begin returning until Q4, and initially at a level well below the prior year. In Africa, the lifting of lockdown measures is behind the Middle East, and the World Health Organisation has stated that Covid-19 infections have yet to peak, which we anticipate will further affect transactions and card issuance in the second half of the year. Accordingly, we expect second half year-on year performance in Africa to be slightly behind Q2.

Our relationships with existing customers remain strong, although the pace of new customer wins, including cross-sell opportunities and outsourcing has slowed in the current environment, as banks focus on the more immediate operational challenges created by the Covid-19 pandemic. Overall, based on current conditions, we expect to see total revenue for FY20 decline between (17)-(20)% year-on-year.

Whilst Covid-19 has impacted volumes and the timing of bank outsourcing, the underlying drivers of our business remain strong, with indications that the transition from cash to cards in our regions is likely to accelerate, driving strong revenue growth over the long term. We continue to be in active dialogue with banks, giving us confidence this is a temporary factor with no underlying change in the appetite to outsource payments processing activities, and which we believe may accelerate post the Covid-19 pandemic.

Our balance sheet is strong and we retain a comfortable liquidity position, with operational cash inflows broadly equal to outflows on an annual basis. We expect to finish FY20 well within the financial covenant threshold on our financing facility, which is 3.5x net debt : underlying EBITDA.

We also intend to recommence progress on our entry into Saudi Arabia as soon as is practicably possible, once border restrictions ease. Saudi Arabia remains a significant growth accelerator for the business, which we believe could become our second largest market over time, requiring a total capital investment of USD25m, over an 18-24 month period (as previously guided). Our decisions announced at Q1, to pause on capital expenditure related to the separation of shared services with Emirates NBD, and defer the ordinary dividend payment in respect of the 2019 financial year, remain in place.

Technical guidance elements:

- Underlying operating costs flat y/y, reflecting our swift actions to manage costs as a result of Covid-19

- Underlying depreciation and amortisation of USD35-38m: slightly lower as a result of reduced capital spend during the year

- Underlying interest cost of USD22-24m

- Specially Disclosed Items i) impacting underlying EBITDA of cUSD13m ii) impacting net income to be a further USD18m

- Write-off of USD7m, related to capitalised issuance fees on the previous debt facility, as previously disclosed

- Underlying tax rate c7-8%: linked to the geographical profit mix as a result of Covid-19

- Capital expenditure of cUSD40-45m. Any incremental capex required to recommence Saudi Arabia market entry will be dependent on lockdown easing and confirmed in due course