The digital transformation is rapidly accelerating as a result of the COVID-19 pandemic, advancing in terms of consumer and business digital usage by up to five years in a matter of around eight weeks.

The playing field has shifted entirely and embracing technology has become pivotal for businesses to survive in the new climate. By now, many companies must have revaluated their existing business models and adjusted them to the digital landscape.

Evolving through change

At NBF, our strategy has been to not only respond to change with agility, but to thrive on it to enhance and strengthen our offering. When we take a closer look at retail banking, for instance, we can see how digital transformation has been sitting at the very centre of its development journey. Over the years, we have been working tirelessly to ensure the user experience reflects enhanced efficiency, better security and resilience, and faster and instant servicing.

The evolving requirements of customers have been serving as a guide for us to continually improve and enhance our operations to ensure maximum efficiency and the most positive customer experiences. With that, we have recognised that the road to transformation is ever evolving and have applied this mindset to all our operations and divisions. Our relationships with our clients have transformed into partnerships, and we have been working with them to ensure that their needs are reflected in all our services and offerings.

Building a community

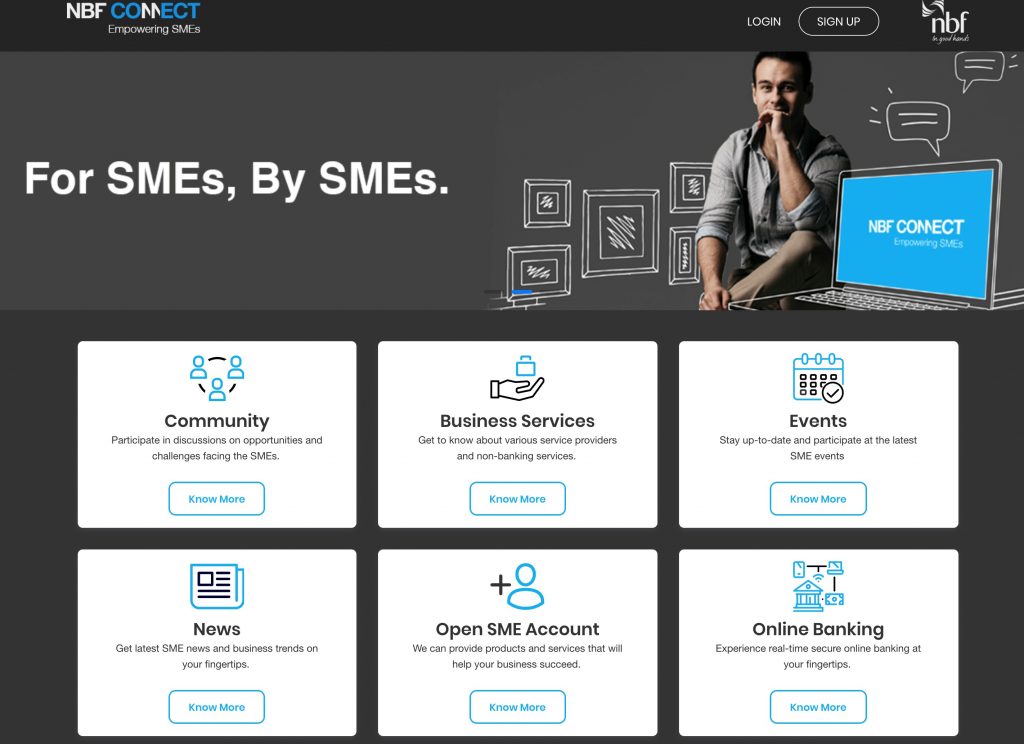

A great example of this is our latest innovation, NBF Connect, a platform that has been co-created alongside our fellow SME clients. We have long recognised the indispensable value that SMEs bring to the country’s economic engine, and with COVID-19 accelerating the transition to the digital world, we wanted to step in and be the first to help digitise this vital sector. As such, we joined forces with SMEs to build a platform that meets their business needs and helps them navigate their growth-journeys.

The aim was to alleviate some of the challenges that currently exist by creating a community where SMEs can share their knowledge and expertise, connect, and engage in industry-related conversations, as well as receive the latest market insights and learn about e-commerce and marketplace management. As a result, NBF Connect became a one-stop-shop for small business owners from all walks of life, allowing them to connect and discover avenues of growth.

What singles out this platform is the community element and the strong support system that it offers. More so, it brings together like-minded entrepreneurs and allows them to gain invaluable insight into a wide range of non-banking offerings, all provided by fellow enterprises. Recognising that knowledge and information are powerful resources, our platform ensures that registered users’ have access to the latest SME news and insights about key business trends and updates. Furthermore, NBF Connect gives access to a calendar so users can stay up-to-date and participate in the latest featured SME events.

For entrepreneurs who are nurturing a new company or transforming their business model to the digital space, NBF Connect features an excellent suite of business services to meet every SME need provided by fellow SMEs such as HR services, legal support, e-commerce, digital tools, and marketplace management. Moreover, new enterprises can easily open a business bank account online within a simple-to-navigate system, and registered clients have access to NBF’s secure online banking service whenever they like and wherever they need it.

It is no surprise that the world has experienced change on a scale that we have not experienced in our lifetime. In a world where we have adopted a new way of working, shopping and living, it becomes instrumental to not only remain abreast of these changes but to move along with this wave with agility, strength and resilience. Platforms like NBF Connect facilitate the necessary transformation and serve as a vital information hub, connecting all those who embark on this vital business revolution.