Emirates NBD has introduced a groundbreaking initiative aimed at stimulating the growth of the UAE’s equity markets. The bank is now offering its customers the opportunity to invest in local stocks at zero transaction fees, making it easier and more attractive to participate in the nation’s economic development.

By providing investors with a seamless and cost-effective way to invest in domestic equities, Emirates NBD is strengthening its commitment to supporting the UAE’s economic agenda.

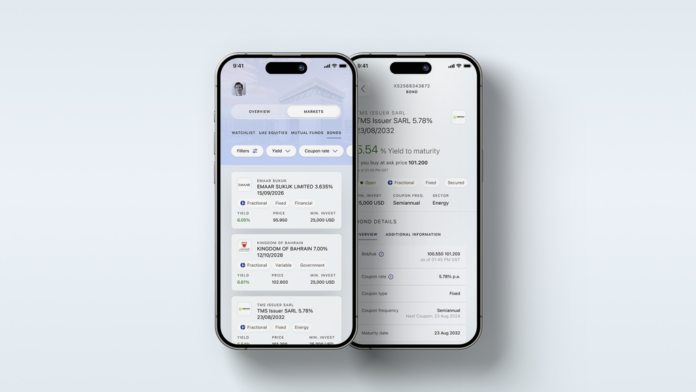

Customers can easily explore and trade local equities on the bank’s mobile banking app, ENBD X, which offers access to over 150 regional stocks. The initiative not only provides investors with a convenient way to diversify their portfolios, but contributes directly to the success of local businesses and the overall growth of the UAE’s economy.

“Our new initiative not only provides investors with access to local equity markets but also allows them to explore and invest in domestic stocks at no cost, presenting an opportunity to diversify their portfolios,” said Marwan Hadi, Group Head of Retail Banking and Wealth Management at Emirates NBD.

Emirates NBD’s digital wealth platform offers a comprehensive range of investment options, including global and local equities. With more than 11,000 global equities and 150 regional equities available to trade, the platform provides investors with a wide variety of choices.

Since its launch last year, the bank has continued to enhance its wealth platform on the ENBD X app.

Earlier in 2024, Emirates NBD introduced fractional bonds, further expanding access to financial markets. The platform offers a secure signing facility for high-volume traders, streamlining the process of completing complex transactions.