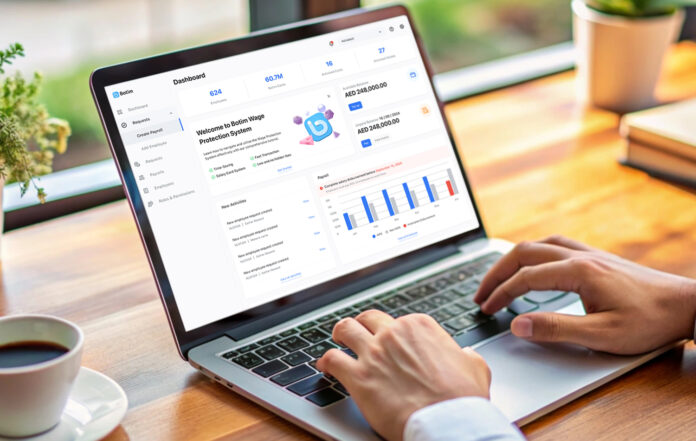

Astra Tech has launched the Botim Payroll Solution—the UAE’s first fully digital payroll solution offering real-time salary processing, in compliance with the UAE’s Wage Protection System (WPS). The new innovative platform is set to provide small and medium-sized enterprises (SMEs) with a more streamlined and integrated approach to payroll management.

The Botim Payroll Solution is designed to support over 557,000 SMEs in the UAE, which contribute 63.5% to the non-oil GDP and represent over 90% of the country’s businesses, according to the The Central Bank of the UAE. It offers a fully digitized process and access to comprehensive financial management tools, including a dedicated business wallet with an International Bank Account Number (IBAN) that separates payroll finances from daily operations. This system eliminates fragmentation, minimizes errors, and enhances overall efficiency.

Abdallah Abu-Sheikh, Founder of Astra Tech and CEO of Botim commented: “The Botim Payroll Solution is a testament to our commitment to innovation and to promoting financial inclusion by providing the underbanked segment with equal access to a full suite of banking services within Astra Tech and Botim’s growing fintech ecosystem. Specifically engineered to empower SMEs by simplifying payroll processes and providing real-time salary management, we are offering a fully digital solution that is tailored to the unique needs of SMEs in the MENA region. By addressing this market gap, we are empowering a wider portion of the population, enhancing both individual and business access to advanced financial solutions, and supporting the UAE’s goal of becoming a fully cashless society.”

Botim Salary Cardholders will benefit from enhanced transparency and control over their finances, along with access to Botim’s fintech features. These include local and international digital money transfers, globally accepted Botim Multi-currency Prepaid Cards, bill payments, and more—all integrated within a single platform. The user-friendly, multilingual digital onboarding process reflects Astra Tech’s commitment to simplifying financial management, promoting financial inclusion, and advancing financial literacy.

According to GlobalData, the value of card payments in the UAE grew by 17.7% in 2022, followed by a 14.6% increase in 2023, reaching Dh451.4 billion. This figure is projected to climb to Dh764.1 billion within four years[1], driven by a growing shift towards electronic payments and increased consumer spending. The rise of fintechs in the region, launching solutions to enhance financial literacy and serve traditionally underbanked segments, has been a significant factor in this growth. In the UAE alone, there are today over 134 fintech companies, with Dubai emerging as one of the region’s leading financial technology hubs.

[1]https://www.globaldata.com/media/banking/uae-card-payments-market-to-surpass-200-billion-in-2028-forecasts-globaldata/