Al Etihad Payments (AEP), a subsidiary of the Central Bank of the UAE (CBUAE), announces the signing of strategic co-badging agreements with leading international card schemes, including Discover®️, Mastercard, UnionPay and Visa. These agreements enhance Jaywan, the UAE’s Domestic Card Scheme, by enabling international transactions while ensuring a strong and efficient domestic payment network.

With these partnerships, Jaywan cardholders will have the flexibility to transact worldwide, leveraging the global reach of leading international payment networks. Within the UAE, transactions will continue to be processed securely through UAESWITCH, maintaining a high standard of reliability and performance.

Saif Al Dhaheri, Chairman of Al Etihad Payments, said: “Jaywan is a key step toward strengthening the UAE’s financial infrastructure, offering a locally rooted payment solution that supports economic growth and digital transformation. We are leveraging advanced technology and strategic partnerships, and we are creating a secure, and efficient payment ecosystem that aligns with the nation’s vision for innovation and financial empowerment.”

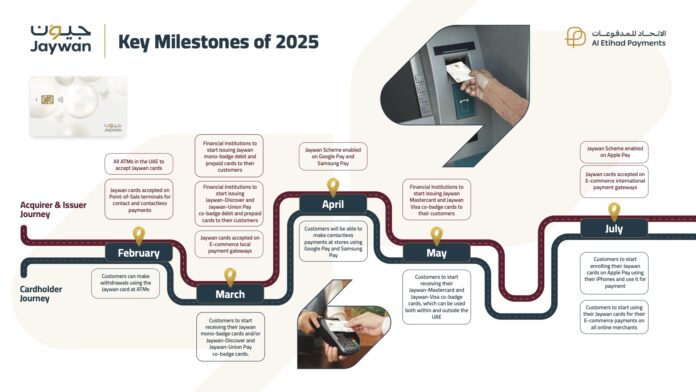

Jaywan will introduce debit and prepaid co-badged cards for everyday transactions, salary disbursements, and secure cross-border payments. UAE financial institutions will begin issuing Jaywan co-badged cards from H2 of 2025.

Jaywan co-badge cards will provide international acceptance, and cardholders can use their cards abroad, ensuring that travel and cross-border payments remain seamless. These partnerships enhance Jaywan’s usability by extending its reach to international merchants, ATMs, and online payment platforms, allowing users to transact effortlessly both in the UAE and beyond.