Abu Dhabi Islamic Bank (ADIB) reported a net profit of AED 1.12 billion and net revenue of AED 3.93 billion for the first nine months of 2020. The bank delivered solid financial performance in the third quarter supported by a rebound in economic activity and positive client sentiment despite an unprecedented global backdrop arising from the COVID-19 pandemic. This resulted in a net profit of AED 533.8 million in Q3 2020, an increase of 68% compared to Q2 2020 and 98% compared to Q1 2020, driven by strong revenues and rigorous cost efficiencies.

Net profit for Q3 was down 14% compared to the same period last year due to an increase in impairment charges and lower revenues, predominantly driven by net profit margin compression that was partially mitigated by a cost reduction of 9%. This was achieved by successfully implementing a number of initiatives, including digital initiatives that helped to reduce the cost of sales and customer acquisition, and by streamlining internal processes. The cost synergies created capacity for the bank to continue investments in digital and strategic initiatives to attract new customers and support ADIB’s long-term growth.

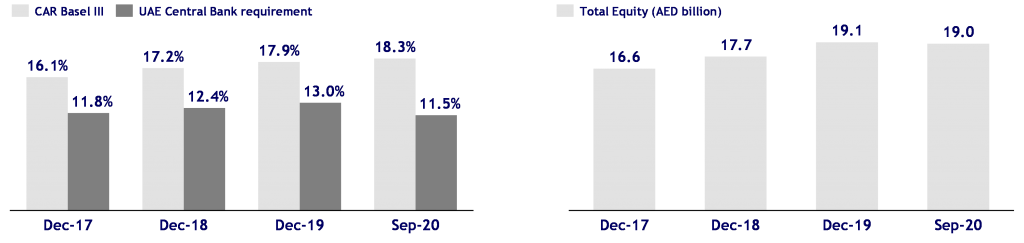

The bank further strengthened its capital, liquidity and funding ratios with a capital adequacy ratio of 18.35%, Tier 1 capital ratio of 17.25%, and a CET1 ratio of 12.66%, all substantially above minimum regulatory requirements. Meanwhile, provisions for the first nine months of 2020 increased by 73% to AED 954.1 million compared to the same period last year, reflecting ongoing challenges in the macro-economic environment.

Resilient performance in light of external environment

- Group net revenue for the first nine months of 2020 was AED 3,932.6 million vs AED 4,390.9 million in first nine months of 2019.

- Group net profit for the first nine months of 2020 was AED 1,121.4 million vs. AED 1,850.5 million in first nine months of 2019.

- Third quarter net profit at AED 533.8 million, a growth of 68% compared to Q2 2020 with operating profits up by 19%.

- Operating expenses decreased by 5.7% to AED 1,871.9 million vs. AED 1,985.5 million in the first nine months of 2019. This reflects the successful implementation of cost initiatives taken to create future efficiencies and continued investment into key strategic and digital programmes designed to support business growth and enhance the customer experience.

- Credit provisions and impairments for the first nine months of 2020 increased by 72.7% to AED 954.1 million from AED 552.5 million in the first nine months of 2019 reflecting the challenging macro- environment, translating to an annualized cost of risk of 146 bps, up from 89 bps compared to the same period last year.

- ADIB continued to maintain one of the lowest cost of funds in the region supported by an efficient funding strategy and a high proportion of CASA balances which enabled the Bank to maintain one of the highest net profit margins in the market at 3.6% for the first nine months of 2020.

- Non-profit income now comprises 40% of total revenue with fees & commissions increasing by 7.4% to AED 300.8 million compared to Q3 2019.

Strong liquidity and capital position

- Total assets of AED 127 billion, up 2.3% year-on-year.

- Net customer financing increased by 5.0% to AED 83.2 billion from AED 79.2 billion as at 30 September 2019.

- Customer deposits at AED 100.7 billion, with CASA balances increasing by 4.0% year on year to AED 75.7 billion, comprising 75.2% of total customer deposits compared to 72.5% a year earlier.

- Advances to stable funds ratio was 87.1% as at 30 September 2020, compared to 83.9% at 30 September 2019 (84.1% at 31 December 2019).

- The bank’s common equity Tier 1 ratio of 12.66% and capital adequacy ratio of 18.35% remain well above minimum regulatory requirements.

- Overall coverage, including collateral at discounted value, stands at 89.1%.

ADIB commentary

H.E Jawaan Awaidah Al Khaili, Chairman of ADIB, said: “Although the macro-economic environment remains uncertain, we have seen positive signs of recovery resulting from the decisive actions taken by the UAE Government. At ADIB, we have been able to deliver a solid performance for the third quarter of 2020 reflecting a rebound in economic activities which generated momentum across all business units. We have witnessed a net income growth of 68% compared to the previous quarter driven by strong revenues and consistent cost discipline. This is a significant achievement during these unprecedented times and was made possible by the resilience of the bank’s businesses and the dedication of our employees adapting to the challenges presented by COVID-19. Our cost of credit has started to stabilize and our levels of capital and liquidity continue to remain strong, with both our common equity Tier-1 ratio and advances to deposits ratio increasing from the end of the previous quarter.

“As a leading Islamic bank, we recognise our important role in supporting the country’s economic recovery. Through this period, we remain committed to our customers by providing relief measures in line with the Central Bank of the UAE’s Targeted Economic Support Scheme (TESS). We have proactively supported over 88,000 corporate and retail customers through the deferral of finance repayments and fee waivers to help alleviate the financial pressures faced by individuals and businesses.

“We have made significant strides in progressing our digital transformation journey to ensure convenient, seamless and uninterrupted banking services to our customers. We launched a number of digital-first initiatives, such as Apple Pay and the Ministry of Finance’s eDirham platform. The demand for our digital banking services continue to gain momentum with 75% of customers now utilizing our digital channels.”

Mohamed Abdelbary, Group Chief Financial Officer at ADIB, added: “Our net profit of AED 533.8 million for the third quarter represents an increase of 68% compared to the previous quarter and is considered a solid performance helped by a gradual rebound in economic activities and positive client sentiments in a period of unprecedented challenges and market volatility coupled with historically low rates. Our retail banking business, which is considered the backbone of the group, delivered a resilient performance demonstrating our market leading capabilities and strong customer base. This has allowed us to maintain one of the highest net profit margins in the market of 3.6% for the first nine months of 2020.

“We continue to exercise a rigorous approach to managing costs which resulted in a 6% decrease in operating expenses compared to the first nine months in 2019. We achieved this by successfully implementing a number of initiatives, including a reduction of cost of sales and cost of customer acquisition, the optimization of our branch network and introduction of AI and robotics to streamline processes. These cost synergies created capacity for us to continue our investments in digital and strategic initiatives to attract new customers and support ADIB’s long-term growth.

“Our balance sheet remains robust with strong liquidity and healthy capital ratios. For first nine months of 2020, we increased our impairment allowance by AED 401.6 million as a prudent measure to protect our resilience amid the lingering effects of the pandemic.”

Group Financial Review

All figures are in AED millions

| Income statement | Q3 2019 | Q3 2020 | Change % | Q2 2020 | Change % | YTD 2019 | YTD 2020 | Change % | |||

| Net Revenue from Funding | 948.2 | 827.0 | -12.8% | 801.8 | 3.1% | 2,865.2 | 2,496.8 | -12.9% | |||

| Fees & Commissions | 280.0 | 300.8 | 7.4% | 205.8 | 46.1% | 747.7 | 717.9 | -4.0% | |||

| Investment income | 195.0 | 188.7 | -3.2% | 217.0 | -13.1% | 542.2 | 557.9 | 2.9% | |||

| FX | 79.2 | 52.6 | -33.6% | 37.6 | 39.8% | 228.7 | 146.6 | -35.9% | |||

| Other income | 1.3 | 7.0 | 422.3% | 2.1 | 240.3% | 7.0 | 13.3 | 89.5% | |||

| Net revenue | 1,503.7 | 1,376.0 | -8.5% | 1,264.3 | 8.8% | 4,390.9 | 3,932.6 | -10.4% | |||

| Total Expenses | 674.8 | 613.5 | -9.1% | 623.5 | -1.6% | 1,985.5 | 1,871.9 | -5.7% | |||

| Operating profit (margin) | 828.9 | 762.5 | -8.0% | 640.8 | 19.0% | 2,405.4 | 2,060.7 | -14.3% | |||

| Credit provisions and impairment charge | 207.5 | 245.5 | 18.3% | 321.5 | -23.7% | 552.5 | 954.1 | 72.7% | |||

| Net profit after zakat & tax | 620.0 | 533.8 | -13.9% | 317.9 | 67.9% | 1,850.5 | 1,121.4 | -39.4% |

| Balance sheet | Sep 2019 | Sep 2020 | Change % | |

| Total assets | 124,285 | 127,116 | 2.3% | |

| Gross customer financing | 82,310 | 86,936 | 5.6% | |

| Customer deposits | 100,364 | 100,722 | 0.4% | |

| Total equity | 18,383 | 18,971 | 3.2% | |

| Customer financing to deposit ratio | 78.9% | 82.6% |

Risk Management

Given the unprecedented impact of Covid-19 and the prevailing economic environment, ADIB has taken significant increases in provisions. As a result, credit provisions and impairments for the first nine months of 2020 increased to AED 954.1 million from AED 552.5 million in the first nine months of 2019.

Asset and Liability Management

ADIB recorded a healthy customer financing-to-deposits ratio of 82.6% as at 30 September 2020. The bank maintained its position as one of the most liquid financial institutions in the UAE. Customer financing assets increased 5.0% year on year on the back of growth in its wholesale banking assets.

Capital strength

Total equity (including Tier 1 capital instruments) was AED 18.9 billion as at 30 September 2020. This represents an increase of 3.2% year-on-year.

ADIB’s capital adequacy ratio under Basel III as at 30 September 2020 was 18.35%, while its Tier 1 capital ratio was 17.25% and its common equity Tier 1 ratio, 12.66%. All capital ratios under Basel III principles are well above the minimum regulatory thresholds advised by the Central Bank of the UAE.

Key Business Highlights in Q3 2020

- ADIB launched “ADIB Rise”, a new banking proposition providing wealth management services and advisory for emerging affluent customers in the UAE.

- ADIB launched a remote sales platform allowing customers to interact with ADIB and apply for personal finance, covered cards, takaful, and other banking products without having to leave their homes.

- ADIB partnered with the UAE’s Ministry of Finance to offer a new range of eDirham card that will enable UAE residents to access 5,000 government services.

- ADIB signed an MoU with the Department of Economic Development to support the growth of Abu Dhabi’s industrial sector through financing and banking services as well as training workshops and educational seminars.

- ADIB introduced Apple Pay to allow customers make contactless payments.

- ADIB signed an MoU with Israel’s Bank Leumi to explore areas for future cooperation in the UAE, Israel and other international markets.

- ADIB acted as the Underwriter, Bookrunner, Initial Mandated Lead Arranger on Tabreed’s successful syndicated finance of US $692 million.

ADIB recorded high levels of digital adoption in the first nine months of 2020

- 75% of all customers are now active on ADIB’s digital banking channels.

- 2 million transactions are conducted every month on ADIB’s mobile app.

- 94% of retail financial transactions, including payments and fund transfers are now conducted digitally.

- 50% of new ADIB customers opened their accounts digitally.

- Over 80% of ADIB’s Global Transaction Banking business was generated digitally through ADIB Direct, an innovative banking platform providing automated trade finance services.

Supporting customers and community during Covid-19

- ADIB continued to implement a variety of measures across the organization to ensure the safety and wellbeing of its employees, including implementing technology-based work from home platforms for staff, implementing strict sterilisation protocols at all its premises, and running awareness programmes on the importance of health and safety.

- ADIB has taken actions to keep customers safe including enhanced cleanings, personal protective equipment, wellness barriers, physical distancing, and virtual client meetings.

- ADIB proactively reached out to customers to offer relief measures including the postponement of monthly payment installments and the reduction of certain fees or charges across a range of products, in line with the Central Bank of the UAE’s Targeted Economic Support

- ADIB continued to develop its digital banking platforms and services to ensure reliable access for clients’ financial needs. This allowed 24/7 access to mobile and online banking tools, virtual communication tools and continued access to cash.

- In addition to supporting customers, ADIB has also offered extensive support to the community during the Covid-19 outbreak. Initiatives include donating AED 25 million to the Ma’an’s ‘Together We Are Good’ programme, designed to encourage financial and in-kind contributions from individuals and companies to support the community.

- ADIB collaborated with the Abu Dhabi Department of Finance to be part of the SME Credit Guarantee Scheme, which aims to bolster the resilience of SMEs by increasing access to finances.