It is accepted that customer engagement produces better outcomes, in terms of customer experience, sales, revenue, profitability and other metrics. To put a number to it, according to a Gallup study, better engagement increases wallet share of companies by 55 percent and 23 percent better performance than competitors. A PWC report states that positive customer experiences are a key driver for purchasing decision for 75% of banking consumers.

Unfortunately, research also shows that financial institutions are not engaging with customers as well as they should. Our recent survey on maximising digital banking engagement, conducted jointly with Qorus found that only 14 percent of banks are successfully engaging customers at scale by proactively offering advice and recommendations; a scant 13 percent say they have fully deployed initiatives empowering employees with real-time insights to improve customer relationships. What are the reasons behind this? The same study hints at the answer.

Channels have not transformed enough

But first, some background. The banking customer engagement journey is going through two waves in parallel. The first wave is seeing routine transactions – bill payment, statement request, even account opening – shift from assisted to self-service channels. On average, progressive financial institutions conduct 95 percent of their basic transactions, and 30-70 percent of new customer onboarding, on self-service digital channels. These banks prepared for this by making huge investments in digital channels and migrating the entire customer lifecycle, from onboarding to upselling, to those channels before anyone else.

The second wave is driving bank transactions out of the bank network, and into the third-party channels of the various participants in the financial ecosystem. It is expected that 50 percent of transactions will move out within the next few years. The exponential growth of India’s UPI-based (open) payments lends credence to this prediction. In September 2022 alone, the transactions numbered 4.5 billion, with an e-commerce giant (Walmart’s PhonePe) and Big Tech (Google Pay) taking over 80 percent share. This is despite 60+ UPI apps from the incumbents, challengers, and neo banks.

Coming back to the study, the findings show that the surveyed banks have barely managed to come to terms with the changes of the first wave. When asked to rate their organisation’s digital transformation maturity across various channels – a reasonable proxy for customer engagement – respondents indicated that they had made some progress on contemporary channels such as online and mobile banking (62 percent said it was successfully deployed at scale), and traditional channels such as branch banking (53 percent). But in the case of emerging channels like open banking/ embedded finance, the results were discouraging, in single digits. This means that while banks may be “managing” wave one, they are clearly unprepared for wave two, and consequently, engaging customers on upcoming and future channels.

Analytics has barely got going

Analytical prowess is a key factor in customer engagement. For this reason, the survey asked respondents how far they used descriptive, diagnostic, predictive and prescriptive insights to engage with customers. Once again, the results were underwhelming, even in the case of descriptive analytics – the first stage in a linear evolution that is followed, in that order, by diagnostic, predictive and finally, prescriptive analytics – the proportion of banks who claimed they were very successful was only 5 percent. So, when it comes to leveraging insights from data and analytics to help customers spend, borrow, save or invest better, it seems that banks are at the earliest stage of the (typically long and multi-stage) customer engagement journey.

Engagement services are grossly underutilised

How well a bank exploits various engagement services, such as personal financial management (PFM) tools or relationship-based pricing, is another key driver of customer engagement. Here too, the performance of the surveyed banks was disappointing. PFM or budgeting tools was the only service where they reported moderate results, with 20 percent of respondents agreeing it had been successfully deployed at scale. Account aggregation (17 percent), integration with accounting or other third-party applications (13 percent), and personalised relationship-based pricing (10 percent) were the only other services to record double-digit results. Banks have every reason to be concerned because in an undifferentiated products and services market, engagement or engagement-led selling is their only way to stand out.

The fourth element in engagement, one that the study does not cover, is unique products. New-age players have led the way in engaging customers with innovative products such as Buy Now Pay Later and Smart Deposits. In contrast, incumbents have let the opportunity slip, allowing fintech companies, neo banks and ecommerce platforms to seize the advantage.

How to achieve Golden Engagement

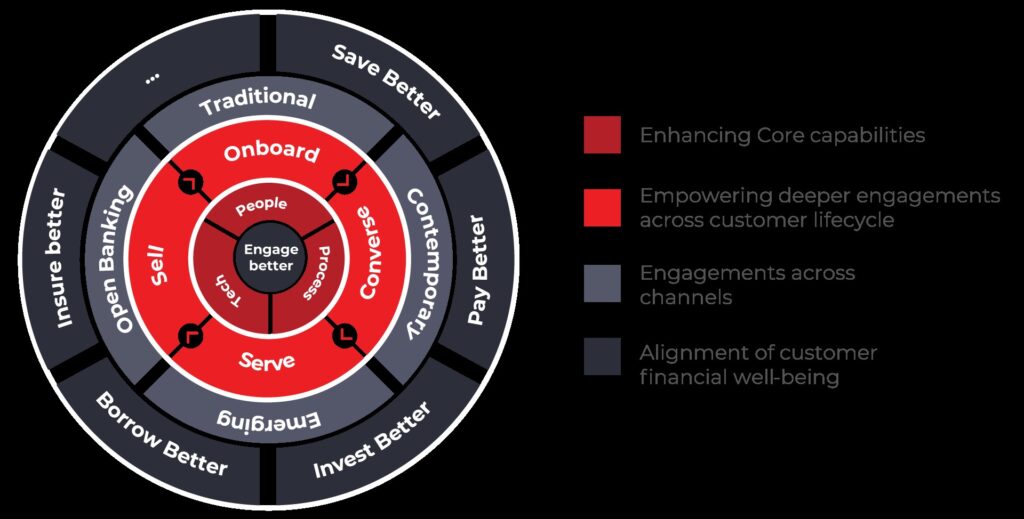

Given the importance of engagement in every area – from customer retention to differentiation –banks need to quickly close the gap to the leaders. However, customer engagement is a long, systematic journey with no short-cuts. Based on our experience, we have devised a three-tier framework called the “Golden Engagement Circle” which can help banks navigate this journey to strengthen engagement across all dimensions.

In brief, the Golden Engagement Circle is a holistic model of customer engagement encompassing the different layers of organisational maturity. The model envisages putting people, processes and technology at the centre to improve banks’ ability to sell, onboard, converse and serve. Seamless integration across channels and platforms further enhances engagement. Done right, with each interaction the bank will help drive financial well-being and empower customers to save, pay, borrow, insure and invest better.

We hope you will find the survey results and the Golden Engagement Circle framework useful to benchmark your organisation’s progress versus peers and take corrective measures where necessary.