I remember when I worked in banking, it wasn’t unusual to take up two years to select a piece of enterprise software, with an expectation that it would take another 2 two years before we actually used it! If these kind of protracted procurement and deployment cycles were becoming a thing of the past, the pandemic is likely to kill them off completely.

Post-pandemic wealth management

The world of wealth management has been shaken up and the rate of digitalization has been accelerated. But, as we have written before, this means more than just using digital channels. It will entail a reappraisal of servicing, sourcing and operating models, together with an expansion of services focused on education and planning

Fast time to value

In the face of this kind of rapid structural change, wealth managers can no longer wait years to implement change. Customers won’t wait that long. Budget holders, scarred from previous overrunning and failed projects, won’t sign it off. And the board won’t stomach the opportunity cost of projects that don’t deliver fast value.

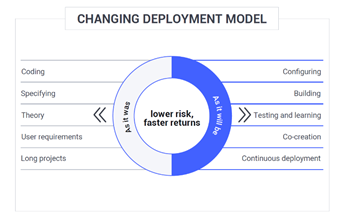

Continuous deployment

Instead, what is needed are short projects with fast feedback loops. Wealth managers need to replace the long sequential cycles of designing, building and deployment with fast testing and iteration, capturing and validating customer feedback and continuously deploying new features.

Risk sharing

Another change we observe is greater risk-sharing between wealth managers and software vendors, which in turn leads to better alignment. In the past, a vendor would sell a software license to a client, giving them a large upfront payday. It was then up to the client to implement, deploy and run the solution.

Today, the risk is shared. Subscription revenues spread risk and reward, while cloud deployment makes switching possible. In effect, it takes longer for the software provider to make profits with a higher risk of attrition, which incentivizes the provider to deliver long-lasting and continuous value to the customer. Furthermore, some vendors like additiv have stopped charging for implementation, making time to value top of mind for vendor and customer alike.

Assets under intelligence

The last major change we see is in how value is created. As the wealth management industry transitions from safeguarding client assets to helping clients achieve their financial goals, so we see a corresponding change in enterprise IT.

As we move from assets under management to assets under intelligence, the features and functions of software give way in importance to data and analytics. The key attribute of wealth management systems today is their ability to it amass and drive insight across multiple datasets – locational, contextual, market, transactional; what we at additiv call a system of intelligence. Systems of intelligence deliver the most relevant and engaging customer interactions at the right time and over the right channel to guide the client to better outcomes

Time to change your approach?

In summary, if your organization is still buying systems based on functional specifications and multi-year deployment plans, then it is time to change. The world has moved on.