Over the past few years, the banking sector has gone through a massive transformation, with the modernisation of payments at the epicentre of this journey. Not only has the pandemic accelerated the pressure for banks to digitise, but they also need to provide value-added services to meet high customer expectations. Providing a superior digital payments experience is key, covering a range of capabilities such as Straight-through Processing (STP), immediate execution with simplicity, efficiency, transparency and security.

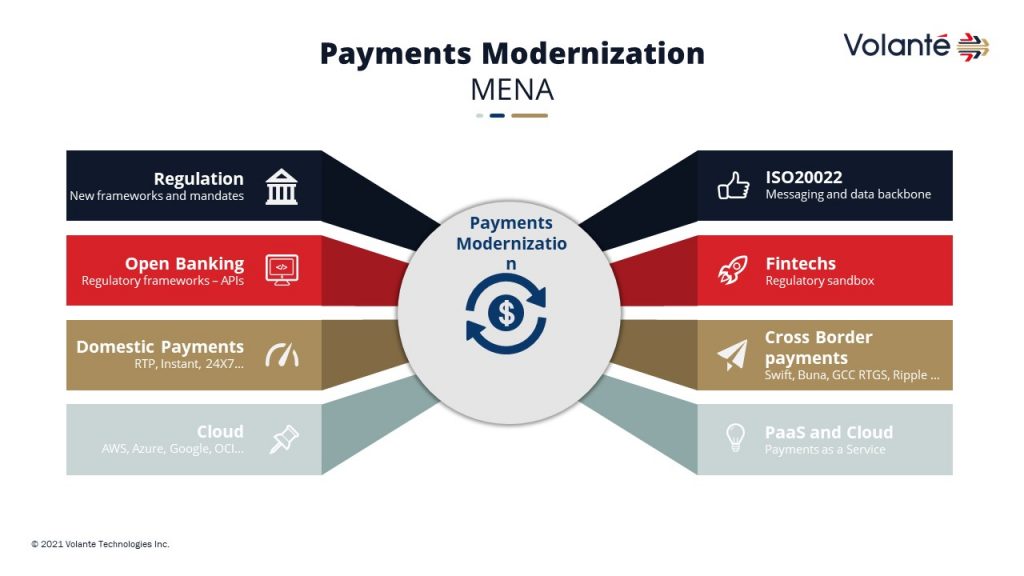

For financial institutions to succeed with their payment modernisation journey, the key ingredients are as follows:

- Regulation: “GiantTechs”, now working hand-in-hand with regulators, enabling Fintechs to quickly adapt and meet growing demand from corporate and retail customers for a better way of handling finance.

- Fintechs: Supported by regulators through receptiveness to cloud availability and open banking frameworks, collaboration between fintechs and banks is becoming the new normal. These partnerships allow banks to offer value-added services to their existing and new customers with greater ease.

- Cloud: Cloud democratisation is on the rise in the region, helping banks speed up payment transformation, collaborate with fintechs through native open APIs, and scale up progressively and securely at optimal cost. Banks can then focus on business and value-added services, rather than maintain costly infrastructure.

- Open banking: Regulators across the region are introducing new Open Banking frameworks to encourage faster, more secure payments and improve banking services overall.

- ISO 20022: ISO 20022 is being adopted for domestic and cross-border payments systems, with SWIFT leading the way starting migration by November 2022, and new real-time networks being designed as ISO 20022 native from the ground up. While this could mean a major IT project for some banks, expected rewards (such as higher STP, reduced fraud and reconciliation efforts) should more than compensate the effort.

- Payments infrastructure modernisation:

- On a domestic basis, a real-time payments revolution is sweeping the region. Besides payment speed, real-time payments systems benefit business customers in terms of availability of remittance data, improved control over payment timing, and technology that supports an “always on” economy.

- Businesses of all sizes are starting to demand faster, more transparent, and cheaper cross-border SWIFT gpi has expanded on the traditional SWIFT correspondent banking network by introducing transparency and other options such as BUNA, AFAQ/GCC RTGS, Visa Direct, Visa B2B Connect, Mastercard Send, and Ripple (blockchain) are diversifying customers’ choices.

- Payments as a Service – PaaS: Cloud-based technologies, API-driven architectures, open banking, and the current pace of evolution in the payment ecosystem, is driving PaaS strategy choice for banks. Banks are looking to capitalize on the opportunity offered by new business models with optimal flexibility and cost in the all too important quest for reducing time to market, meeting regulatory and compliance requirements and, increasing agility and speed when delivering value-added services to end customers.

While the above presents a real opportunity for banks and financial institutions to get ahead of the competition by bringing new customer experiences to market, most banks are being held back by legacy technology.

To meet today’s customer demands, regulatory mandates and capitalise on the opportunity, financial institutions need to modernise their payments infrastructures. When doing so, they should look for platforms that are cloud-native and cloud-ready, microservices-based, and API-enabled. Continuous real-time operation is essential, as is 24×7 availability. ISO 20022 fluency is a must. They should also look for proven solutions that allow them to bring new capabilities and services to market with minimal effort.

At Volante, we are proud to be partnering with a wide range of leading global and regional financial institutions. Our payments modernisation solutions enable banks to free themselves from the limitations of legacy, so they can focus on their true goal: strengthening their positions as leaders and innovators and delivering distinctive value to their customers.

About Volante Technologies

Volante Technologies is the leading global provider of cloud payments and financial messaging solutions to accelerate digital transformation. We serve as a trusted partner to over 100 banks, financial institutions, market infrastructures, clearing houses, and corporate treasuries in 35 countries. Our solutions and services process millions of transactions and trillions in value every day, powering four of the top five corporate banks, 40% of all US commercial bank deposits, and 70% of worldwide card traffic.

Volante’s cloud-native ecosystem of business services simplifies and automates complex systems and processes in payments, capital markets, and financial message integration. Built on a microservices architecture underpinned by an ISO 20022 canonical model, it is designed to accelerate financial institutions’ payments modernization journeys, allowing them to deploy only the services they need, without coding or complex systems integration programmes.

All of Volante’s solutions can be deployed in bank data centers and private clouds, or as a managed service in Volante’s secure cloud, providing institutions with greater agility and choice, while lowering the cost and duration of modernisation implementations.