Overview

Activity around payments across our region has been fast and energetic in recent years and is set to remain the same for some time to come.Digitisation and technology, regulators and governments, standardisation and competition, fintechs and non-financial institutions, global circumstances and consumer demand have all, individually or collectively been pushing the rate at which payments are evolving.

We saw that our region has been largely resilient to the numerous challenges currently facing the world, with many local economies coping better with the stresses than many of their international counterparts. This has meant that in the development of payments, there have been fewer brakes on the wheels speeding along the payments rails, helping the region keep pace with, even pull alongside other world centres.

Likewise, the region’s banking and finance sectors performed healthily, even robustly, helping to boost them purposefully toward their digitisation and technologically supported destinies.

Nearly the whole region is set up and primed for innovation. Key economies in the region are enacting policies and providing incentives to encourage the adoption of technology. This is clearly evident in the banking and finance sectors of the region, where we appear to be experiencing an era of growth for the technology companies servicing these sectors.

As all generations of clients and customers become increasingly familiar with new techniques, the beneficial conveniences and the more flexible options that digitisation brings them, this era of growth looks set continue.

MEA Finance Leaders in Payments Conference and Awards 2023 will gather regional leaders in Banking and Finance, Technology and Fintechs, Regulators and Standardisation Organisations in a series of lively and highly topical panel debates. The Conference discussions will focus upon the evolution of payments in the region, the changes technology can bring, as well as the trends that are leading them and the shape of the tasks ahead needed to establish effective, efficient and safe payments systems. The innovation and prestigious efforts of the banks, financial institutions, payments providers and technology suppliers have put into making the region’s payments systems the envy of the world will be spotlighted and acknowledged following the conference at the 2023 MEA Finance Leaders in Payments Awards.

What to expect?

- More than 300 regional banking, payments and technology leaders with a format attracting the entire spectrum of interested professionals including regulators, technology companies, startups, fintechs, central banks, innovators and other stakeholders from the value chains.

- Solid engagement opportunities for your company with decision makers, to directly detail your company’s solutions to today’s most pressing payments related issues.

- Exposure to the regional banking communities with your brand visibility in the networking and exhibition area during breaks and through participation in panel discussions and keynote presentations

- Opportunities to be recognised and celebrated as a bank, a payments business or technology provider at the forefront of payments transformation and progress at the MEA Finance Leaders in Payments Conference and Awards.

Who should attend?

- Chief Executive Officer

- Chief Financial Officer

- Chief Technology Officer

- Chief Information Officer

- Chief Operating Officer

- Chairman

- Chief Audit Executive

- Chief Commercial Officer

- Chief Economist and Head of Research

- Chief of Shared Services Officer

- Chief Risk Officer

- Managing Director

- MD - Head of Treasury, Capital Markets & FI Department & Section Heads

- Partner - Financial Services

- Advisor - Investment Management

- Commercial Advisor

- Executive Director

- Head of Client Relations

- Head of Payments, Remittances & Foreign Exchange

- Head of Regulatory Advisory and Assurance

- Head of Transaction Banking

- Head Corporate Relations and Strategic Partnerships

- Head Digital Strategy and Change

- Head of Corporate Communications

- Head Digital Strategy and Change

- Head of E-Banking

- Head of Market Risk

- Head of AML & Sanctions

- Head of Bancassurance

- Head of CAD, Remedial & Collection

- Head of Central Operations

- Head of Change Management

- Head of Client Experience

- Head of Compliance

- Head of CRM

- Head of Disclosure and Issuance Department

- Head of Enterprise Architecture

- Head of Enterprise Banking Platforms

- Head of External Communications

- Head of Finance

- Head of Financial Institutions

- Head of Government Relations & PR

- Head of Information Security

- Head of Investment Solutions

- Head of Issuance

- Head of Prepaid Cards

- Head of Regulatory Compliance

- Head of Retail Banking

- Head of Risk Specialist

- Head of Strategic Planning

- Head of Strategy - Technology

- Head of Transaction Banking

- Head Product Manager

- Manager Audit & Compliance

- Manager Operational Risk

- Payments & Contract Manager

- Portfolio Specialist - Insights & Strategy

- Project Manager

- Regional Compliance Manager

- Regional Manager - Compliance & Risk Retention & Vigilance Manager

- Senior CRM Project Lead

- Senior CX Manager

- Senior Manager - Digital Transformation

- Senior Manager Treasury

- Information Security, Senior Strategic Advisor

- Senior Trade Officer, Strategy & PMO

- Assistant Vice President - Global Customer Relations

- Associate VP - Strategic Engagements

- AVP Agile Delivery - Retail Banking

- AVP Credit Risk and Portfolio Manager

- FS Strategy Manager

- SVP & Head of Compliance - Personal Banking Group

- SVP & Regional Head - Corporate & Commercial Banking

- Vice President, Compliance

- VP Risk and Change Management

- VP Wealth and Asset Management

- VP - Strategic Initiatives & Bancassurance

Agenda

Thursday, 14 September 2023

08:00 - 09:00 Registration & Networking

09:00 - 09:15 Welcome Note

09:15 - 09:30 Keynote Address

There is much activity across the region at this time concerning the regulation and the standardisation of payments. Do regulations and standardisation act as catalysts for developing payments technology or are the innovations coming from fintech’s and vendors pushing the regulators and payments organisations to adapt to the marketplace? Is it one or the other of these factors, or are both sides consciously working together to create the payments ecosystem we will soon inhabit, and how might CBDC’s fit into the payment’s equations and to what end?

10:15 - 10:30 Presentation

Can a focus on faster payments enable or enhance your chances of achieving these goals? For example, could faster loans funding build greater earnings from interest over a financial year? Either way, is it not a brutal reality that Real Time Payments will eventually be standard and those that do not get on board soon, will be left behind to deal with the consequences of hesitation?

11:15 - 11:45 Coffee Break

11:45 - 12:00 In conversation with

Many banks are moving payments functions to The Cloud as part of their payments growth strategy, but are they going all the way to adopt cloud computing for full payment processing? Will banks ever replace current payment processing with a completely cloud-native version? In payments terms, what opportunities, benefits and advantages does the cloud specifically offer to FI’s and how can cloud-native payment platforms face challenges such as security, compliance, outages and demands for speedy performance?

At the time of this discussion, ISO 20022 will have been available for processing for six-months, remodeling, maybe even rejuvenating cross-border payments. This panel will review these first six months in the new ISO 20022 world we now inhabit, to assess whether there has been any immediate impact, if signs or patterns are emerging pointing to a new economic environment resulting from implementation, or if it is pretty much business as usual, just a little less bumpy than before.

13:30 - 14:30 LUNCH

What are the opportunities to monetise Real Time payments for ROIs that noticeably add to margins? Can this be done while also remaining cognisant that regulators will likely pressure banks to tighten management of third-party partnerships with fintechs and payments companies, and de-risk to avoid possible banking calamities, thus increasing the costs of compliance for financial institutions?

There is much talk about how RTP, ISO20022, IPP, The Cloud etc., will reduce pain-points and bring quicker and smoother experiences for your bank’s customers and clients, but are the end user businesses and customers actually going to care? Do they notice differentiation between financial institutions offering RTP and those that do not? How can banks and their partner fintech and technology suppliers engage with customers to understand how they actually feel, what they might want next, and how can they distinguish between long-term trends and short-term fads?

16:00 - 16:05 Closing Remarks/End of Summit

16:30 - 17:30 Awards Registration

17:30 - 18:30 Awards Ceremony

Speakers

-

Jamal Saleh

Director GeneralUAE Banks Federation

Jamal Saleh

Director GeneralUAE Banks Federation

-

Ahmed El Hefnawy

Chief Business Service OfficerBUNA

Ahmed El Hefnawy

Chief Business Service OfficerBUNA

-

Altaf Ahmed

Director, Digital Payments & Retail Solutionse&

Altaf Ahmed

Director, Digital Payments & Retail Solutionse&

-

Anand Sampath

Managing Director, Head- Payments, Collections & Client ImplementationFirst Abu Dhabi Bank

Anand Sampath

Managing Director, Head- Payments, Collections & Client ImplementationFirst Abu Dhabi Bank

-

Anna Zeitlin

Fintech DirectorPwC

Anna Zeitlin

Fintech DirectorPwC

-

Arjun Vir Singh

Partner, Global Financial Services PracticeArthur D Little

Arjun Vir Singh

Partner, Global Financial Services PracticeArthur D Little

-

Devid Jegerson

Chief Operating OfficerInvest Bank

Devid Jegerson

Chief Operating OfficerInvest Bank

-

Ellis Wang

Board of The Executive & Advisory TeamSheikh Maktoum Private Office

Ellis Wang

Board of The Executive & Advisory TeamSheikh Maktoum Private Office

-

Faisal Alhijawi

Chief Strategy & Development OfficerBUNA

Faisal Alhijawi

Chief Strategy & Development OfficerBUNA

-

Gabrielle Inzirillo

Head of Ecosystem DevelopmentAbu Dhabi Global Market (ADGM)

Gabrielle Inzirillo

Head of Ecosystem DevelopmentAbu Dhabi Global Market (ADGM)

-

Gautam Dutta

MD & Head - Cash Product Management & InnovationFirst Abu Dhabi Bank

Gautam Dutta

MD & Head - Cash Product Management & InnovationFirst Abu Dhabi Bank

-

George Hojeige

Chief Executive OfficerVirtugroup

George Hojeige

Chief Executive OfficerVirtugroup

-

Goncalo Traquina

PartnerKPMG

Goncalo Traquina

PartnerKPMG

-

Ibtissam Ouassif

Co-Founder & CPOCashew Payments

Ibtissam Ouassif

Co-Founder & CPOCashew Payments

-

Jagadeshwaran K

Managing Director - Treasury & Trade Solutions, MENAPTCiti

Jagadeshwaran K

Managing Director - Treasury & Trade Solutions, MENAPTCiti

-

Ken Coghill

Director - Head of Innovation & Technology Risk SupervisionDFSA

Ken Coghill

Director - Head of Innovation & Technology Risk SupervisionDFSA

-

Lucian Crisan

Senior Manager - Fintech and Financial ServicesPwC

Lucian Crisan

Senior Manager - Fintech and Financial ServicesPwC

-

Mahmoud Abuebeid

CEO & Board MemberGlobal Software Solutions (GSS) Group

Mahmoud Abuebeid

CEO & Board MemberGlobal Software Solutions (GSS) Group

-

Mohammed Roushdy

FounderFintech Bazaar

Mohammed Roushdy

FounderFintech Bazaar

-

Mohammed Wassim Khayata

CEOAl Maryah Community Bank

Mohammed Wassim Khayata

CEOAl Maryah Community Bank

-

Navin Gupta

Managing Director, South Asia and MENARipple

Navin Gupta

Managing Director, South Asia and MENARipple

-

Nisreen Al Matarweh

Account DirectorSwift

Nisreen Al Matarweh

Account DirectorSwift

-

Omar Haddad

General Manager, GCCPaymob

Omar Haddad

General Manager, GCCPaymob

-

Onur Kursun

Head of New Payment Platforms, Eastern Europe, Middle East and AfricaMastercard

Onur Kursun

Head of New Payment Platforms, Eastern Europe, Middle East and AfricaMastercard

-

Onur Ozan

Regional Head, Middle East, North Africa & TurkeySwift

Onur Ozan

Regional Head, Middle East, North Africa & TurkeySwift

-

Pritesh Kotecha

SVP, MEASASmartstream Technologies

Pritesh Kotecha

SVP, MEASASmartstream Technologies

-

Saad Ansari

Co Founder & CEOXpence

Saad Ansari

Co Founder & CEOXpence

-

Sagar Chandiramani

CEOWorkerAppz Payments

Sagar Chandiramani

CEOWorkerAppz Payments

-

Samer Soliman

Chief Executive OfficerArab Financial Services (AFS)

Samer Soliman

Chief Executive OfficerArab Financial Services (AFS)

-

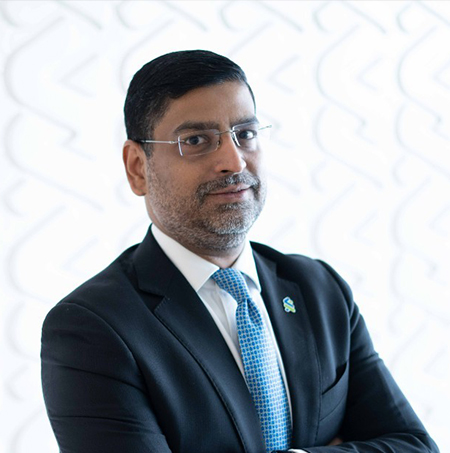

Sanjiv Purushotam

Managing PartnerBridge DFS

Sanjiv Purushotam

Managing PartnerBridge DFS

-

Siva Subramaniam

Head - Product Management - Payments & Cash ManagementInfosys Finacle

Siva Subramaniam

Head - Product Management - Payments & Cash ManagementInfosys Finacle

-

Sreedevi Mani

Vice President - Payments PlatformEmirates NBD

Sreedevi Mani

Vice President - Payments PlatformEmirates NBD

-

Vibhor Mundhada

Chief Executive Officer at NEOPAYMashreq

Vibhor Mundhada

Chief Executive Officer at NEOPAYMashreq

-

Viplav Rathore

Managing Director - Head of Cash Management Products for Africa & MENAPStandard Chartered Bank

Viplav Rathore

Managing Director - Head of Cash Management Products for Africa & MENAPStandard Chartered Bank

MORE SPEAKERS TO BE ANNOUNCED

Keeping Ahead of the Competition in the Changing Payments Environment

Customers’ and client expectations are rapidly changing. They inhabit a world where ease and speed of gratification are offered for many aspects of their daily lives, and they increasingly expect the same seamless, fast or instantaneous experiences in their banking and financial transactions too.Payments are probably the leading engagement touchpoint between financial institutions and their customers, whether retail or commercial and how they are conducted, from start to settlement, is central to the bank/customer relationship. As such, payments are vital to a financial institution’s success.

It is up to banks and financial institutions to either meet these expectations or to lose business to rivals and new actors in the market. But with so many serious considerations and essential steps in the payments process - data security, credit approvals, encryption, KYC, verifications, regulations and many others, how are financial institutions going to balance speed of service with transaction safety and profitability?

The MEA Finance Leaders in Payments Conference and Awards 2023 will address these challenges, highlight the real opportunities and celebrate the innovation and excellence that financial institutions, payments providers and technology suppliers of our region are putting into better payments provision today.

Categories

Click below to view individual award categories and submit nominations.

Awarded to the Payment Gateway business, clearly providing the best service across factors including payment options, reliability, security, market integration, pricing and currency support.

Nominate Now

Awarded to the business providing the most comprehensive opportunity for online companies to manage their payment processes in one place, from beginning to end.

Nominate Now

Nominees for this award will be companies in the region that have shown the most innovation in making quick clearance and settlement of payments a reality, using underlying payments rails.

Nominate Now

Winning this award will be a bank or financial institution in the region that has shown market leading initiative in commissioning and implementing quick clearance and settlement of payments using new or underlying payments rails.

Nominate Now

Awarded to the provider of ancillary services for a real-time payments method that definitively shows the best provision of options beyond core payment processing and adding value to standard payments.

Nominate Now

Nominations for this award will be from business that, in addition to providing leading edge technology in payments has through their implementation also helped to advance their local payments environment.

Nominate Now

Nominations for this award will be from business that, in addition to providing leading edge technology in payments has through their implementation also helped to advance their local payments environment.

Nominate Now

The award will be presented to the financial institution, fintech or technology company that can show it has brought the best ease of process and delight to users of their payments systems or methods.

Nominate Now

The award will be presented to the financial institution, fintech or technology company that can show it has brought the best ease of process and delight to users of their payments systems or methods.

Nominate Now

Awarded to the technology provider that can demonstrate the best solutions and services for the provision of cross-border payments in the region.

Nominate Now

This award will go to the business or organisation that has been judged to have made the most significant contribution to the regional cross-border payments landscape in the recent past.

Nominate Now

Nominees in this category will demonstrate the best cloud-located services across the payment value chain including cost optimisation, improved scalability, high security, faster functionality roll-out and flexible pricing.

Nominate Now

The winner of this award will be users or providers of payments solutions that brought easier access for third party providers or enabled financial institutions to comply with the regulations and increase their services.

Nominate Now

This is awarded to the company or financial institution that best demonstrates both the specific intention and results in bringing all communities the opportunities to transact and create improved life options.

Nominate Now

Awarded to the bank or financial institution that commissioned and completed an instant payments technology implementation that enhanced the services offered to their clients and contributed to their wider banking technology development objectives and profitability.

Nominate Now

Awarded to the business that provided a payments technology implementation that enhanced the services offered to their clients’ markets but also, through the overall commission of their activities, contributed to the wider national payments and banking technology development objectives.

Nominate Now

This award goes remittance payments and over the counter foreign exchange services company providing the best access via a broad branch network, digital services, speed of service and readily available range of currencies, meeting the needs of the communities depending on these services.

Nominate Now

In the highly populated and diverse payments services space in the region, this award will go to the company or institution judged as having made the most successful and beneficial contribution to this sector.

Nominate Now

Nominations are welcome from companies, financial institutions, organisations, associations or individuals that, over the past year to eighteen months, can demonstratively define an innovation of note in the regional payments market.

Nominate Now

Nominations are welcome from companies, financial institutions, organisations, associations or individuals that, over the past year to eighteen months, can demonstratively define an innovation of note in the regional payments market.

Nominate Now

This award will be presented to the company that in the past twelve to eighteen months has shown the most original and dedicated focus in supplying technology that has offered the most potential or definitively improved the payments experience for the market.

Nominate Now

This award is presented to the individual that through their efforts has been assessed to have made the most noticeable contribution to the technological advancement of the regional payments sector.

Nominate Now

This award will be presented to the executive in a leading position that has worked through their career to guide and lead businesses through the ever-evolving digital payments landscape, keeping them at the forefront of their respective markets.

Nominate Now

This award is presented to the individual that through their efforts has been assessed to have made the most noticeable contribution to the advancement of service and management in the regional payments sector.

Nominate Now

About the awards

Conceived and based in our exciting, dynamic and promising region, MEA Finance was established with the goal of serving the regional banking and financial services sector. We are committed to providing dedicated news, insightful interviews, the highestlevel events and thought leadership from the region’s financial service providers and banking technology leaders. MEA Finance is best placed to cover the full range of the banking and financial sectors, from retail to investment banking; wealth management to Islamic finance, and the fast-developing technology that powers the industry today. As part of our integral role in the region’s banking sector, we benchmark, recognise and actively encourage excellence within institutions.Now that the activity around payments across our region has been relevantly emerging, MEA Finance Leaders in Payments Awards 2023 will give due recognition and celebrate the achievements of the region’s top innovation and prestigious efforts of the banks, financial institutions, payments providers and technology suppliers have put into making the region’s payments systems the envy of the world.

NOMINATE NOW

- Open for Entries: 17thJuly 2023

- Submission Deadline: 28thAugust 2023

- Judging Process: 4thSeptember 2023

- Awards Ceremony: 14thSeptember 2023

Submission Process

MEA Finance conducts its own research to ensure that our awards categories accurately reflect the current payments ecosystem and comprehensively recognise the achievements of the industry.

As a result, we have determined 21 award categories that provide regional recognition to exceptional banks, financial institutions and technology providers who are shaping the new digital financial landscape and have made outstanding contributions to the future of the industry. Institutions can nominate themselves in all relevant categories as deemed appropriate, provided the submission is sent in before the deadline, and in the required format.

NOMINATE NOW

HOW TO ENTER

It is important to review the individual descriptions and criteria before choosing your category.

*Submissions deadline 28thAugust 2023.

Judging Process

The awards will feature a rigorous two-step judging process by a panel of industry experts in collaboration with the MEA Finance editorial team.

- All nomination entries will be meticulously evaluated and analysed based on relevant market knowledge, industry research, and accurate company financial statements. The MEA Finance editorial team will then create a shortlist which will be given to the judging panel.

- The judging panel will be composed of senior executives from professional services firms working with the banking industry. They will review the shortlist and the submitted materials for each category and place a score from 1 to 5 for each category nominee. All scores will be sent back to the editorial team.

- The MEA Finance editorial team will independently score shortlisted institutions per category. Score values will be from 1 to 5. All scores will be kept confidential and will not be released publicly, nor will they be discussed with any individual applicants.

- Scores from both the judging panel and the editorial team shall be collected and combined. The editorial team will hold an official tabulation of the scores to determine the highest scoring institution per category which will be declared winner

Sponsors

FOR SPEAKING, SPONSORSHIP & EXHIBITION ENQUIRIES:

FOR SPEAKING & AGENDA ENQUIRIES:

Venue

Ritz-Carlton JBR, Dubai, United Arab Emirates