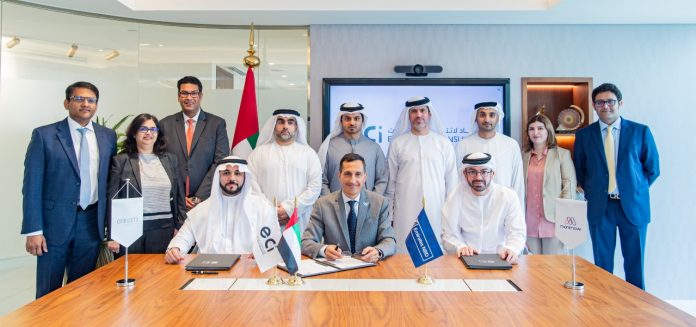

Etihad Credit Insurance (ECI), the UAE Federal export credit company, has signed an MoU with Emirates NBD and Crediti Fintech, for the implementation of the ‘UAE Trade Finance Gateway’. The innovative receivables financing marketplace is designed to help businesses based in the UAE obtain fast and easy access to finance and boost their business, while supporting the UAE’s ‘Operation 300bn’ industrial strategy which aims to raise the sector’s contribution to GDP from AED133 billion to AED300 billion by 2031.

The public-private partnership will position ECI as the main gateway enabling ECI, banks and exporters to trade credit and financial solutions on one unified platform. ECI insurance cover will enable businesses to obtain secured loans from Emirates NBD, powered by Crediti Fintech’s Monimove platform.

In addition to Emirates NBD, ECI is also collaborating with other banks in the UAE to encourage smooth collaboration between all parties in an end-to-end digitised process with standardised mechanisms for counterparties to monetise their receivables.

Supported by the UAE Ministry of Economy, the project effectively addresses the shortage or restricted availability of trade finance solutions for small enterprises, while simplifying cumbersome, confusing and time-consuming processes.

Commenting on this agreement, Massimo Falcioni, CEO of Etihad Credit Insurance, said: “Launched as part of the UAE’s golden jubilee, The UAE Trade Finance Gateway addresses a number of challenges faced by exporters and re-exporters in obtaining finance to fund their working capital requirements. In collaboration with leading banks and financial institutions in the country, it will help SMEs through a wide range of financial and technological solutions to establish a strong SME sector and a resilient economy. We’re delighted to partner with Emirates NBD to further boost UAE’s economic development.”

Meanwhile, Ahmed Al Qassim, Group Head, Corporate and Institutional Banking at Emirates NBD, said: “We are delighted to form this strategic alliance with ECI and Crediti Fintech to be part of the UAE Trade Finance Gateway. A receivables financing marketplace backed by ECI’s strong insurance coverage will help to strengthen the financial supply chain for UAE businesses and further boost the nation’s position as a global trade hub. A strong financial supply chain network not only helps small enterprises in obtaining faster financing at competitive rates, it also benefits large corporates by meeting consumer demand and supporting sustainable business growth. Such robust, inclusive financing facilities will immensely benefit our economy, helping businesses grow and raising the industrial sector’s contribution to the UAE’s GDP. As a digital frontrunner in the region’s banking sector, Emirates NBD remains committed to creating innovative solutions that fuel economic growth in close alignment with the UAE government’s strategies.”

Hashim Al Hussaini, Crediti CEO & MoniMove Co-Founder, stated: “Exporters and re-exporters, especially those belonging to SME sectors, encounter several obstacles in international trading. With the ‘UAE Trade Finance Gateway’, the UAE is all set to facilitate a comprehensive solution to these concerns through an exceptional platform that helps businesses in the UAE to grow exponentially in regional and global markets. We are pleased and honoured to forge this alliance with ECI and Emirates NBD to make a vital contribution to this path-breaking initiative that is deemed to play a crucial role in the country’s economic vision for the next 50 years.”

Furthermore, Dr. Hamad Al Ali, RSP CEO and Crediti Board Member, stated: “Through this partnership with ECI and Emirates NBD, we are confident that we will contribute to the growth of our innovation-driven economy by boosting the global competitiveness of our companies.”