Dubai Islamic Bank today announced its results for the period ending June 30, 2020.

1H2020 Results Highlights:

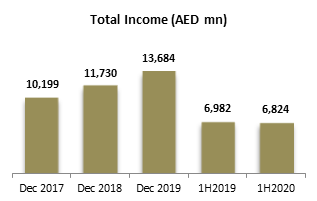

- Total Income reached AED 6,824 million, marginally below the similar period last year, despite headwinds.

- Group Net Profit reached to AED 2,118 million during the first half of the year.

- Net financing and Sukuk investments grew to AED 237.1 billion vs AED 184.2 billion in 2019, up by 29% YTD.

- Customer deposits increased to AED 206.5 billion up by 26% YTD.

- CASA component increased to 41% from 33% in 2019 supported by strong focus on operating accounts.

- Total assets now at AED 295 billion, up by 27% YTD.

- Cost to income ratio improved to 29.4% as impact of Noor Bank integration synergies start to flow through.

- ROA is at 1.94% and ROE at 15.5%.

- Financing to deposit ratio stood at 97%.

- NPF ratio is at 4.5%.

- Overall coverage, including collateral at discounted value, stands at 114%.

- Capital adequacy ratio is at 16.7% whilst CET 1 ratio is at 12.3%.

Management’s comments for the period ending 30 June 2020:

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank, said:

- The new UAE government structure, along with more than AED 6 billion Dubai economic stimulus measures that were unveiled by the leadership, are designed to bolster the market and boost investor confidence during and post the Covid era. As the pandemic is gradually contained, Dubai and the UAE’s sustainable business growth models remain on track to lead the economic recovery in the region.

- During these critical times, we continue to engage effectively with all our stakeholders in order to ensure that our business operations are seamless. DIB remains focused on delivering its strategic aspirations that are primarily aimed at providing sustainable long-term returns for our valued shareholders.

Dubai Islamic Bank Managing Director, Abdulla Al Hamli, said:

- The gradual return of economic activities is a manifestation of Dubai’s capabilities to withstand and address any significant global economic shocks. DIB has been able to quickly adapt to the so-called “new normal” in terms of servicing our customers via our diverse channels including the branch network and digital platforms, with minimal business disruption blended with stringent safety measures.

- We continue to see significant growth across our digital platforms in the online space, driven by the on-going commitment towards DIB’s digital journey. Knowing that the digital economy is a critical pillar in UAE’s future economic development, DIB remains focused on capturing the growth opportunities in the post-Covid era.

Dubai Islamic Bank Group Chief Executive Officer, Dr. Adnan Chilwan, said:

- 2020 has turned out to be an exceptionally unusual year for the global economy thus far, due to the lingering uncertainty as to when the pandemic would materially subside. Despite everything, the year has seen us hit new milestones, with both customer financing and deposits crossing the AED 200 billion mark and the balance sheet now approaching the coveted AED 300 billion level. Whilst monitoring the situation closely, we have managed to sustain our overall business performance, thus resulting in quality growth, healthy capitalization and ample liquidity.

- We continue to deliver on our promise to all stakeholders, irrespective of the challenges around. The last decade has seen us align to the market factors and environmental constraints, tweaking and re-tweaking our strategy with agility and focus, to ensure business continuity and financial success, and we are confident that we will emerge even stronger from the current challenges.

- In a bid to realign our strategy and build on our strength in the domestic market, the quarter saw a strong advancement in our financing book of 11% QoQ, driven by our calculated focus on sovereign and related businesses. This deliberate strategy may result in a short-term dilution of margins, but we believe, will lead to a more sustainable business model, particularly given the current uncertain macro-environment, and will also help preserve the strength of our balance sheet and continue to generate stable returns in the future.

- On the funding side of the balance sheet, our persistent efforts to grow low cost deposits has led to CASA now reaching more than 40% of overall customer deposits, a significant increase of 57% YTD and 17% QoQ. In addition, the highly successful Sukuk issuances of USD 1.3 billion demonstrate the attractiveness of the credit and the confidence of global markets in the DIB franchise, during these unprecedented times.

- During the quarter, we initiated the execution phase of the Noor Bank integration program, and have successfully completed key deliverables, particularly relating to policies, operating model and data migration. The integration is on track for completion by YE2020, and we anticipate further synergies to materialize over the course of the year.

Financial Review:

Income Statement highlights:

| AED million | June 2019 | June 2020 | YoY Change % |

| Total Income | 6,982 | 6,824 | (2%) |

| Depositors’/ Sukuk holders share of profit | (2,282) | (2,101) | (8%) |

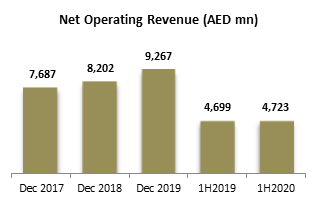

| Net Operating revenue | 4,699 | 4,723 | 0.5% |

| Operating expenses | (1,201) | (1,470) | 22% |

| Profit before impairment losses & income tax | 3,498 | 3,253 | (7%) |

| Impairment losses | (725) | (2,120) | 192% |

| Gain on Bargain Purchase | – | 1,015 | 100% |

| Income tax | (21) | (30) | 44% |

| Net profit for the period | 2,753 | 2,118 | (23%) |

| Key ratios | Dec 2019 | June 2020 | Change |

| Net Profit Margin % | 3.15% | 2.82% | (33 bps) |

| Cost to income ratio % | 26.9% | 29.4% | 250 bps |

| Return on average assets % | 2.25% | 1.94% | (31 bps) |

| Return on average equity % | 17.1% | 15.5% | (160 bps) |

Income and Net Revenues

The bank’s total income reached AED 6.82 billion in 1H2020 whilst net operating revenue grew to AED 4.72 billion. Despite a subdued quarter, the bank continues to deliver broadly stable total income and net operating revenues in comparison to the same period in 2019.

Costs

Operating expenses reached AED 1,470 million in 1H2020 against AED 1,201 million in the same period in 1H2019. The rise in expenses is attributed to the integration costs incurred in the preceding quarter as part of the acquisition exercise. Cost to income ratio stood at 29.4% in 1H2020, improved by 40 bps vs Q1 2020 (29.8%).

Net Profit

The net profit of the bank in 1H2020 reached to AED 2,118 million. Amidst a difficult quarter, DIB continues to demonstrate healthy profitability whilst ensuring prudence in growing the balance sheet. Realignment of strategy coupled with a strong pipeline is expected to support financial performance going forward.

Statement of financial position highlights:

| AED Million | Dec 2019 | June 2020 | Change YTD (%) | |

| Net Financing and Sukuk Investments | 184,157 | 237,099 | 29% | |

| Interbank placement & CDs | 16,275 | 27,316 | 68% | |

| Equities & Properties Investments | 9,788 | 11,484 | 17% | |

| Cash & Other assets | 21,576 | 18,898 | (12%) | |

| Total assets | 231,796 | 294,797 | 27% | |

| Customers’ deposits | 164,418 | 206,521 | 26% | |

| Sukuk Financing Instruments | 14,852 | 18,607 | 25% | |

| Total liabilities | 197,064 | 255,567 | 30% | |

| Shareholder Equity & Reserve | 25,565 | 28,240 | 10% | |

| Tier 1 Sukuk | 6,428 | 8,264 | 29% | |

| Non-Controlling Interest | 2,739 | 2,726 | (0.5%) | |

| Total liabilities and equity | 231,796 | 294,797 | 27% |

| Key ratios: | Dec 2019 | June 2020 | Change |

| Net Financing to customer deposit | 92.0% | 97.0% | 500 bps |

| CET 1 ratio | 12.0% | 12.3% | 30 bps |

| CAR | 16.5% | 16.7% | 20 bps |

| NPF ratio | 3.9% | 4.5% | 60 bps |

| Coverage ratio | 101.0% | 81% | (20%) |

Financing and Sukuk portfolio

The net financing & Sukuk investments has now increased to AED 237.1billion in 1H2020 from AED 184.2billion at the end of 2019, a robust rise of 29%. Around AED 20 billion were deployed in new financing growth driven by the realignment of strategy focusing on lower risk sectors, particularly sovereigns. Gross new consumer financing amounted to AED 6.1 bn during 1H2020.

Asset Quality

Non-performing financing (NPF) ratio and impaired financing ratio stood at 4.5% and 4.4% respectively. Cash coverage and overall coverage ratio, including collateral at discounted value stood at 81% and 114% respectively. Normalized cost of risk for the period was 98 bps (excluding one-off charges).

Customer Deposits

Customer deposits grew to AED 207 billion from AED 164 billion at year-end 2019 reflecting a growth of 26% YTD, reaffirming the bank’s strength to mobilize deposits despite challenging environment.

CASA rose by nearly 57% to AED 85.7 billion, growing from AED 54.6 billion in year-end 2019 and AED 73.4 billion in Q1 2020. This currently represents about 41% of customer deposits. Net financing to deposit ratio stood at 97% signifying ample liquidity during these times.

Capital Adequacy

Capital adequacy ratios remain healthy with overall CAR at 16.7% and CET 1 ratio 12.3% respectively.

Despite the relaxed capital requirements due to Covid 19 outbreak, the bank continues to have healthy capital ratios well above the regulatory thresholds.