Principal investors in the Middle East – comprising of the likes of Sovereign Wealth Funds (SWFs), family offices, private equity companies, and institutional investors – are experts at identifying and hunting for new investment opportunities through decades of experience in understanding the shifts in the market and putting the right deals together. However, similar to other industries, the emergence of the pandemic has brought to light the importance of technologies, data practices, and ways of working that investors have traditionally relied on the need to be recalibrated to sustain strong performance. In fact, according to our research, adopting a new focus towards digital, data and analytics can enhance this by USD 6 Billion or 0.2%.

Often, the challenges faced by investors are the fragmentation of data management, leading to a struggle in how to manage and use data in a way that can benefit the investor decisions. In the Middle East, however, the challenge is much more profound, where the concept of data usage in investment is not a key consideration. The issue stems from the fact that there is a lack of understanding of how data can be used for investor advantage, such as identifying investment opportunities or track the progress of portfolio companies.

In addition to the under exploitation of data, Middle Eastern investors face two other key challenges:

Agility with a Lack of Focus. Middle Eastern investors are more agile in their ways of working when compared to other markets, which has a siloed approach to investment structures. While this may provide a more seamless approach to investment, it does not provide a concentrated area of expertise, leading to a ‘jack of all trades’ scenario. Without leveraging technology and data efficiently, this creates waste in frontline capacity, where it can be put to use to hunt for better investment opportunities.

Changing Environment Demands for Disruption. With unpredictability and uncertainties surrounding the environment, both in the Middle East and around the world, there can only be two outcomes: opportunities for growth or the dangers of succumbing to those who innovate to adapt to the new future. COVID-19 has shown the power of digital, data, and analytics, and how opportunities can be created by leveraging new technologies. In the current market state, Middle Eastern investors are relying on their expertise of the market to target the most visible targets that generate the strongest return, however, it is vital to evolve by involving data and analytics into the decision mix to identify better investment opportunities to hunt for.

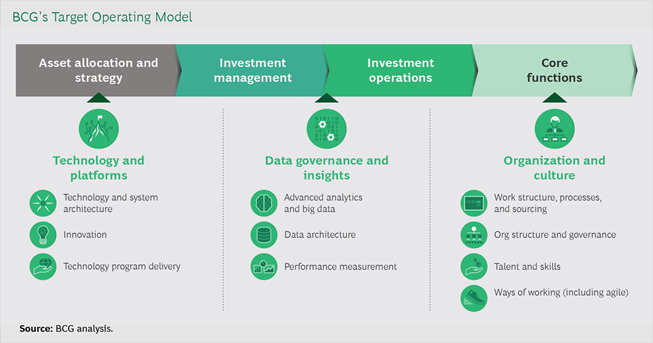

To address these challenges, we’ve identified three imperatives that investors can take to build operational resilience. In our experience on case works, addressing these core topics comprehensively can help firms improve assets under management by an average of 5 to 7 basis points. Designing an operating model for the future requires core elements that include technology and platforms, data and insights, and organization and culture. Middle East investors don’t need to pursue a massive overhaul all at once. Instead, they can lay the groundwork by focusing on the specific capabilities they need to gain resilience in the post-crisis environment.

- Move Toward a Modern Platform Based on Modular Architecture. Shifting to modern platforms can help to deliver greater functionality, agility, and improved cost performance. From our experience, investment firms can realize average cost savings of 7 to 10 percentage points. The modular architecture makes it easier for firms to integrate systems end to end, allowing data to be shared across systems and manual tasks to be automated. Many of the modular architecture platforms available today are software-as-a-service subscriptions, which can be less expensive to acquire and maintain since updates are managed by the software provider and require significantly less IT involvement on the investor side. As such, many come with various offerings that can be integrated for a more seamless working environment – such as cloud storage so that investors can access an expansive catalog of services and solutions to support new asset class and investor strategies or even mobile extensions that can facilitate remote work.

While implementing a modern platform is a longer-term outlook, investors can begin by doing the following:

- Map the systems, processes, and data flows in each step of the investment decision-making process to identify critical data needs, as well as key bottlenecks in the system

- Ensure that the right process controls are in place

- Prioritize relatively easy, short-term changes that can help to mitigate acute challenges while longer-term system implementation unfolds.

- Unlock Insights by Formalizing Data Governance. Establishing a data governance function to align on a “single source of truth” and enforce data management changes is vital to close the knowledge gap and make data easier to access across all functions. For instance, alignment on a common set of data inputs to calculate critical metrics, such as internal rate of return, mark-to-market valuations, and debt service coverage ratios, can be a helpful place to start. With a common data architecture, investors can process information from external sources easier, and then they can collate inputs, such as volume and trade information, and then feed that data into automated analytical processes. As they refine their data taxonomies and libraries, investors can begin to develop more specialized use cases and algorithms. In the long-run, investor firms can expand their data governance footprint, to create a data center of excellence as a single resource or establishing a hub-and-spoke model, with a centralized unit in charge of core data governance and data stewards housed within the business who work with teams to develop and deploy analytics.

- Create an Organization and a Culture That Embrace New Ways of Working. There are three primary areas that investors can adapt to in the organization to win in the post-pandemic environment. Firstly, to embrace the agile ways of working to provide a platform of accountability, transparency, and resiliency that is needed to increase productivity and efficiency. Secondly, to structure teams around a specific set of business and customer objectives to create a knowledge-sharing based organization, which pools insights across a function that can foster a shared sense of purpose. Third and the final area is employing cross-training into the standard operating practice to create a flexible firm, which helps to avoid leaving other functions short-handed. Also, the opportunity to expand professional skillsets is appealing to many employees and one that often results in higher rates of retention and greater recruitment success.

The new reality of the post-pandemic is surrounded by uncertainties, however, the important takeaway is that investors be prepared for this ever-changing and dynamic environment. Rethinking the operating model can provide Middle Eastern investors with the opportunity to be more resilient and responsive, capable of managing through adversity, and delivering sustainable growth.