AuraData Technologies LLC is a globally operating business with executive management counting 300+ years of financial industry experience and a team of banking domain and technology experts. We bring global best practices and a deep understanding of regional nuances to provide tailor-made solutions at an optimised cost for our customers across Middle East & Africa.

Says Srinivas Pramod, Co-Founder & CEO, “We are witnessing increasing adoption of our Digital TAP framework across leading banks in Middle East & Africa. Digital TAP is not just a methodology; it’s our promise to banks to guide them through every step of their digital transformation journey, delivering measurable outcomes and larger stakeholder value.”

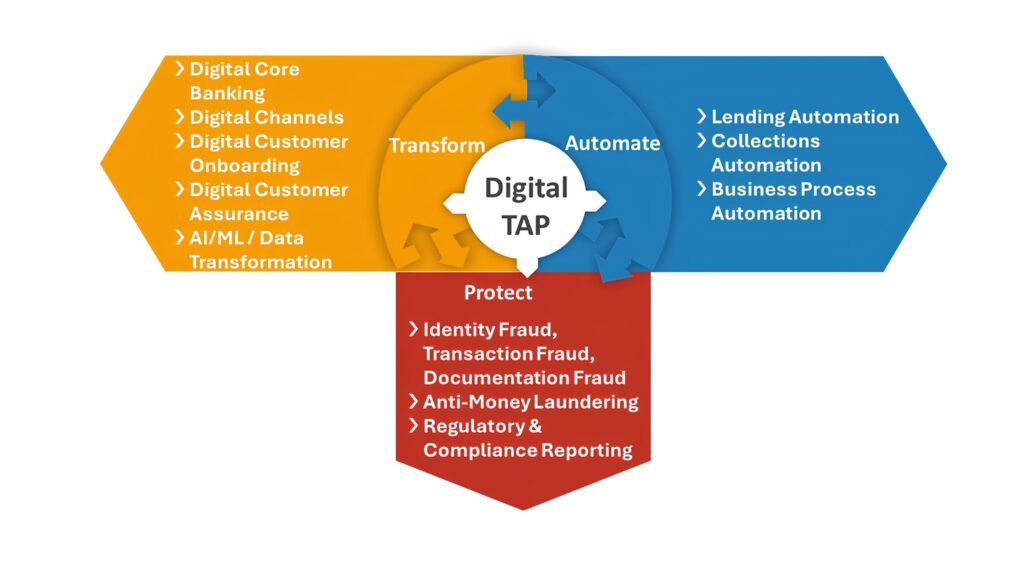

How Digital TAP™ Framework Delivers results for Banks

- Transform: We help reimagine core banking processes & customer interactions. We help transitioning/ modernisation by enhancing scalability, flexibility and real-time processing capabilities, through integrating and optimising diverse digital channels (mobile, web, ATM, branch) for a seamless, omni-channel customer experience, leveraging API-first architectures to facilitate open banking initiatives and foster collaboration within the financial ecosystem.

- Automate: Digital Lending Automation and Process automation is directly aimed at driving operational excellence and accelerating time to market for new financial products. We leverage advanced technologies such as digital lending, collections, Intelligent automation and Robotic Process Automation (RPA) workflow orchestration to streamline repetitive tasks, reduce manual errors and accelerate operational processes.

- Protect: AuraData helps banks move from a reactive fraud and compliance approach to a proactive, real-time EFM approach for today’s ever-changing regulatory environment. Powered by AI and machine learning, advanced user behaviour patterns analysis, cross- channel real time enterprise fraud management, unusual system usage and anomaly detection, we ensure regulatory adherence. And with our regional regulatory reporting and comprehensive Anti-Money Laundering (AML) solutions, including transaction monitoring, customer due diligence (CDD), suspicious activity (SAR), we provide a smoother and more secure banking experience, protecting against novel and sophisticated fraudulent tactics or schemes which go unnoticed in siloed systems.

” By harnessing a global talent pool with regional expertise and experience, we deliver on the promise to our customers using the AuraAssure Delivery framework, a combination of hybrid delivery model, agile project management, transparent communication and measurable outcomes coupled with extensive post-implementation support & continuous optimisation services, thereby maximising long-term impact and sustainable benefits for customers,” says Mahesh Cukkemane, Co- Founder & Chief Delivery Officer

Kumar Dandapani, Director- Banking Practice adds, “The future of banking is predictive. With the advent of AI and increased regional digital thrust, banks across Middle East & Africa are trying to bolster their non-interest fee-based incomes, deliver hyper-personalised customer experience, launch new products and services rapidly at scale while striking a balancing act of managing operational efficiency, adhering to increasing compliance requirements and enhanced fraud detection. Digital TAP is an ideal framework to address this comprehensively.”

(website: https://www.auradatacorp.com/ )