Overview

Transaction Banking - Transaction Banking, often referred to as GTB - Global Transaction Banking is more than a key revenue stream for banks and financial institutions, it is unquestionably a vital component of the trading abilities of businesses and as such, essential to the health of national economies.With many economies across the Middle East travelling determinedly along the route to growth and development, most notably in the GCC, there is going to be an expanding need for Transaction Banking services and facilities. This in itself is a challenge, but it is also happening along with epochal change in the regional banking system as the application of technology and the use of AI becomes normal, in fact expected of our financial institutions.

If we add into this mix the fact that regional economies are driven in large part by SMEs who, with today’s communications options, will be trading more expansively and in diverse locations, plus transnational initiatives and standardisation all aimed at speeding and smoothing cross-border payments, banks have a lot to focus on in their Transaction Banking business.

How are banks in our region going to adapt, compete, recruit the talent and remain profitable in the face of the changes and heightening competition they will face?

The MEA Finance, Transaction Banking Summit, 2024, will gather national and regional leaders from Banks, Corporates, Technology, Fintech and Government to address these questions in a programme of lively and highly topical panel debates. The Summit discussions will focus upon the growth of Transaction Banking across the region, its essential importance to the economies of the region and how the inevitable application of technology and AI will shape the processes and practices animating it.

What to expect

- More than 300 banking and technology leaders with a format attracting the entire spectrum of interested professionals including regulators, technology companies, start-ups, fintechs, innovators and other stakeholders from the value chains.

- Solid engagement opportunities for your company with decision makers, to directly tell them about your company’s solutions to today’s most pressing industry issues

- Exposure to the regional banking fraternity with your brand visibility in the exhibition area during networking breaks and via participation in panel discussions and keynote presentations

Who should attend?

- Chief Executive Officer

- Chief Financial Officer

- Chief Technology Officer

- MD - Head of Treasury, Capital Markets & FI

- Chief Operating Officer

- Chairman

- Chief Audit Executive

- Chief Commercial Officer

- Chief Economist and Head of Research

- Chief of Shared Services Officer

- Chief Risk Officer

- Managing Director

- Partner - Financial Services

- Advisor - Investment Management

- Commercial Advisor

- Executive Director

- Head of Client Relations

- Head of Payments, Remittances & FX

- Head of Regulatory Advisory and Assurance

- Head of Transaction Banking

- Head Corporate Relations and Strategic Partnerships

- Head Digital Strategy and Change

- Head of Corporate Communications

- Head Digital Strategy and Change

- Head of E-Banking

- Head of Market Risk

- Head of AML & Sanctions

- Head of Bancassurance

- Head of CAD, Remedial & Collection

- Head of Central Operations

- Head of Change Management

- Head of Client Experience

- Head of Compliance

- Head of CRM

- Head of Disclosure and Issuance Department

- Head of Enterprise Architecture

- Head of Enterprise Banking Platforms

- Head of External Communications

- Head of Finance

- Head of Financial Institutions

- Head of Government Relations & PR

- Head of Information Security

- Head of Investment Solutions

- Head of Issuance

- Head of Prepaid Cards

- Head of Regulatory Compliance

- Head of Retail Banking

- Head of Risk Specialist

- Head of Strategic Planning

- Head of Strategy - Technology

- Head of Transaction Banking

- Head Product Manager

- Manager Audit & Compliance

- Manager Operational Risk

- Payments & Contract Manager

- Portfolio Specialist - Insights & Strategy

- Project Manager

- Regional Compliance Manager

- Regional Manager - Compliance & Risk Retention & Vigilance Manager

- Senior CRM Project Lead

- Senior CX Manager

- Senior Manager - Digital Transformation

- Senior Manager Treasury

- Information Security, Senior Strategic Advisor

- Senior Trade Officer, Strategy & PMO

- Assistant Vice President - Global Customer Relations

- Associate VP - Strategic Engagements

- AVP Agile Delivery - Retail Banking

- AVP Credit Risk and Portfolio Manager

- FS Strategy Manager

- SVP & Head of Compliance - Personal Banking Group

- SVP & Regional Head - Corporate & Commercial Banking

- Vice President, Compliance

- VP Risk and Change Management

- VP Wealth and Asset Management

- VP - Strategic Initiatives & Bancassurance

Agenda

Wednesday, 12 June 2024

08:00 - 09:00 Arrival & Registration

09:15 - 09:20 Welcome note

09:20 - 09:30 Keynote Address: Mr. Mohammed Alsarrani, Deputy Director General of the Financial Sector Development Program (FSDP), Ministry of Finance, Saudi Arabia

The Middle East can become a world leading commercial hub. Gifted with natural entrepreneurship, positive demographics and visionary objectives - such as Vision 2030, this potential must be supported by effective and secure transaction banking and payments. However, the lingering challenges of payment fragmentation, ongoing and looming geo-political crises, current interest rate regimes and the seismic changes technology will usher in, are just some of the hurdles to be overcome. How will Transaction Banking and Payments adapt to the challenges of today’s world and can they, in the face of existing and future challenges, meaningfully contribute to our region’s potential to become a world leading global business hub.

Transaction Banking, seen as relatively low risk, nevertheless is subject to forces that can have negative outcomes, such as operational risks that include currency volatility and interest rate activity; increasing geo-political flare-ups or natural disasters; fraud and cyber-crime, to name some. What can be done to take away or mitigate such dangers? Will cross-border standardisation initiatives reduce, and can technology help avert operational risk? Will AI reduce or even solve fraud risk? What opportunities are there for technology companies, in partnership with banks to prepare for or soften the consequences of events or the unexpected?

11:00 - 11:15 Mindgate Presentation

11:15 - 11:45 COFFEE BREAK

Technology will command an increasingly prominent role in Transaction Banking, solving business problems by creating new efficiencies, speeding processes and offering solutions for smoothing out the rockier parts of the journey. However, there will remain parts of the process, such as cross-border bureaucracy and unforeseeable natural or geo-political circumstances that place obstacles and obstructions. Will technology always be a welcome tool to solve problems and salve the rough spots, or might it also add greater risk and expanded threats of cyber security and crime, especially in the payments realm?

12:30 - 12:45 IBM Presentation

It need not be mentioned how payments are fundamental to Transaction Banking, but it is worth discussing how payments are evolving in the region. Is standardisation and enhancement by multi-currency platforms supported by central banks having an effect? How are initiatives, such as ISO 20022, AFAQ or Buna benefitting banks and businesses involved in regional payments? Are they helping to iron out inefficiencies with costly outcomes that delay payments, hinder the ability to manage cash flow and can cost companies sales. Can or will the 2027 target developed by the Financial Stability Board at the G20 for more transparent, cheaper and faster and accessible payments be met?

13:30 - 14:30 LUNCH

14:30 - 14:45 DiXio Presentation

With competition in the region growing, putting pressure on margins, plus the costs of risk management and compliance, can AI and the Cloud keep revenues healthy? While largely the case in retail banking, can their advantages apply to Transaction Banking? What decisions can or should a bank make between localisation or globalisation of data centres? As AI evolves, could it predict challenging situations and provide solutions to circumstances that previously would have been unavoidable or costly? How far can and will Al and the use of the cloud advance in the commission and provision of Transaction Banking?

15:30 - 16:00 COFFEE BREAK/ NETWORKING

Speakers

-

KEYNOTE

Mohammed Alsarrani

Deputy Director General of the Financial Sector Development Program (FSDP)Ministry of Finance, Saudi Arabia

Mohammed Alsarrani

Deputy Director General of the Financial Sector Development Program (FSDP)Ministry of Finance, Saudi Arabia

-

Dr. Ahmed Darwish Elsayed

Head of Digital DeliveryBank Albilad

Dr. Ahmed Darwish Elsayed

Head of Digital DeliveryBank Albilad

-

Ahmed Ghandour

Managing Director - Middle EastBackbase

Ahmed Ghandour

Managing Director - Middle EastBackbase

-

Alexis Haessler

Regional Head, Middle-East & LevantACI Worldwide

Alexis Haessler

Regional Head, Middle-East & LevantACI Worldwide

-

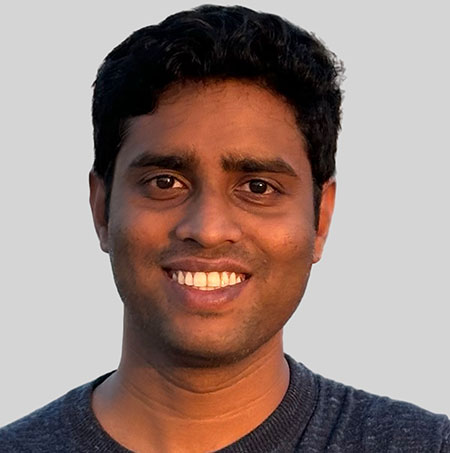

Amol Bahuguna

SVP, Head of Corporate Technology, Innovation and Change ManagementRiyad Bank

Amol Bahuguna

SVP, Head of Corporate Technology, Innovation and Change ManagementRiyad Bank

-

Anand Sampath

MD, Head - Global PaymentsFirst Abu Dhabi Bank

Anand Sampath

MD, Head - Global PaymentsFirst Abu Dhabi Bank

-

Anjum Noman Mirza

Executive Vice President, Head - Trade Finance Solutions GTB GroupThe Saudi National Bank

Anjum Noman Mirza

Executive Vice President, Head - Trade Finance Solutions GTB GroupThe Saudi National Bank

-

Balaji Muthu

Executive Director - MENAMindgate Solutions

Balaji Muthu

Executive Director - MENAMindgate Solutions

-

Bushra Alghamdi

Head of Artificial IntelligenceAlinma

Bushra Alghamdi

Head of Artificial IntelligenceAlinma

-

Camelia Olteanu

Vice President, Group OperationsQatar National Bank

Camelia Olteanu

Vice President, Group OperationsQatar National Bank

-

Cem Soydemir

Head of Payments Go-To-Market, MEA, South & Central AsiaSwift

Cem Soydemir

Head of Payments Go-To-Market, MEA, South & Central AsiaSwift

-

Damon Madden

Strategic Solution Consultant - Fraud, MEASAACI Worldwide

Damon Madden

Strategic Solution Consultant - Fraud, MEASAACI Worldwide

-

Deekshith Marla

FounderArya.ai, an Aurion Pro company

Deekshith Marla

FounderArya.ai, an Aurion Pro company

-

Finali Fernando

Managing Director, Regional Head of Products, CCO and Business Management Global Payments SolutionsHSBC

Finali Fernando

Managing Director, Regional Head of Products, CCO and Business Management Global Payments SolutionsHSBC

-

Gurpreet Saluja

Executive Director, Financial ServicesJP Morgan

Gurpreet Saluja

Executive Director, Financial ServicesJP Morgan

-

Haitham Abu Ghazaleh

Head of Enterprise Risk ManagementConfidential

Haitham Abu Ghazaleh

Head of Enterprise Risk ManagementConfidential

-

Huny Garg

Country Head - KSASwift

Huny Garg

Country Head - KSASwift

-

Joude Badra

General Manager KSADiXio

Joude Badra

General Manager KSADiXio

-

Karim Sanjakdar

Enterprise Business Development ManagerAllied Engineering Group

Karim Sanjakdar

Enterprise Business Development ManagerAllied Engineering Group

-

Ladle Patel

Senior AI AdvisorArab National Bank

Ladle Patel

Senior AI AdvisorArab National Bank

-

Martin Blechta

PartnerBoston Consulting Group

Martin Blechta

PartnerBoston Consulting Group

-

Marwan Dardounh

Chief Technology OfficerIBM Saudi Arabia

Marwan Dardounh

Chief Technology OfficerIBM Saudi Arabia

-

Nahim Bassa

SVP, Group Head of Strategy & TransformationBank Aljazira

Nahim Bassa

SVP, Group Head of Strategy & TransformationBank Aljazira

-

Najma Salman

Managing Director, Co-Head - Central Europe, Middle East & Africa for Institutional Cash & Trade Deutsche Bank

Najma Salman

Managing Director, Co-Head - Central Europe, Middle East & Africa for Institutional Cash & Trade Deutsche Bank

-

Oleksandr Savchenko

Executive Director - Head of Trade, Working Capital & Transaction BankingStandard Chartered

Oleksandr Savchenko

Executive Director - Head of Trade, Working Capital & Transaction BankingStandard Chartered

-

Olga J. Parra

Data & AI Brand LeaderIBM Middle East and Africa

Olga J. Parra

Data & AI Brand LeaderIBM Middle East and Africa

-

Onur Ozan

Managing Director / Regional Head - MENATSwift

Onur Ozan

Managing Director / Regional Head - MENATSwift

-

Rakan Alajroush

SVP, Head of Global Transaction BankingRiyad Bank

Rakan Alajroush

SVP, Head of Global Transaction BankingRiyad Bank

-

Reem Alshammari

Head of Treasury and Trade Solutions - KSACiti

Reem Alshammari

Head of Treasury and Trade Solutions - KSACiti

-

Sajjad Baloch

Head of Applications DevelopmentBayan Credit Bureau

Sajjad Baloch

Head of Applications DevelopmentBayan Credit Bureau

-

Shaikh Manzoor Sabir

Head of Cash ProductsGulf International Bank

Shaikh Manzoor Sabir

Head of Cash ProductsGulf International Bank

-

Siva Subramaniam

Head - Product Management - Payments & Cash ManagementInfosys Finacle

Siva Subramaniam

Head - Product Management - Payments & Cash ManagementInfosys Finacle

-

Suruj Dutta

PartnerEY

Suruj Dutta

PartnerEY

-

Talat Qureishi

Vice President, Business Development Commercial EEMEAMastercard

Talat Qureishi

Vice President, Business Development Commercial EEMEAMastercard

-

Thierry Simon

Chief Executive OfficerUnion of Arab & French Banks (UBAF)

Thierry Simon

Chief Executive OfficerUnion of Arab & French Banks (UBAF)

-

Venkata Surya Prasad Indraganti

Senior AGM, Head of Transaction BankingCommercial Bank of Qatar

Venkata Surya Prasad Indraganti

Senior AGM, Head of Transaction BankingCommercial Bank of Qatar

-

Waqas Khan

Head of Enterprise ArchitectureBSF

Waqas Khan

Head of Enterprise ArchitectureBSF

-

Wissam Massud

Director of International Expansion and Allianceshaifin

Wissam Massud

Director of International Expansion and Allianceshaifin